Is agtech computer vision going mainstream?

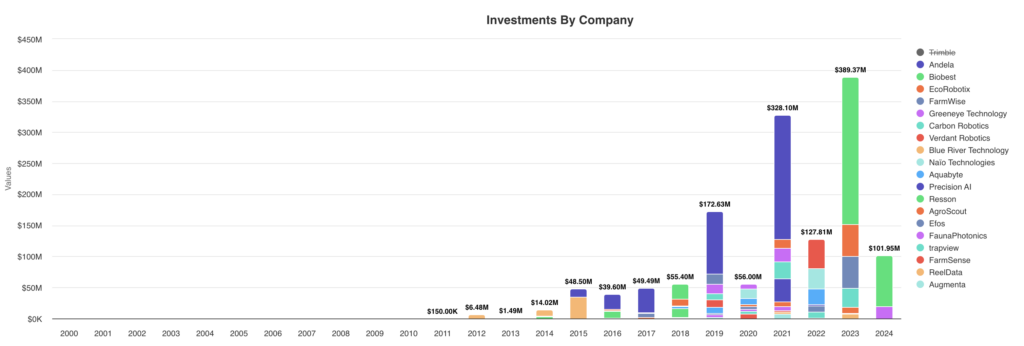

Figure 1. Top 20 equity raisings by computer vision agtech (excl Trimble)

Greeneye Technology last week raised $20 million for its version of computer vision-based herbicide control, adding to more than $5.2 billion raised to date by equity investors, for companies using graphics processing units (GPUs), to bring AI to precision ag.

What these AI start-ups have in common is the use of cameras, GPUs and image recognition algorithms to detect anything from pests, to crop nitrogen levels, or fruit ripeness.

In the case of AI-backed herbicide companies like Greeneye Technology, computer vision is used to adjust sprayers in milliseconds (or “real-time”), to turn on or off the application of crop protection products, depending on the actual presence of weeds.

At New Food Finance, we analyse how tech and other companies are driving solutions for an environmental transition in food production, for example to reduce greenhouse emissions, and air and water pollution, or protect and restore biodiversity.

Our data shows that 69 tech companies globally are developing “real-time camera-based AI” for a range of uses, including pest and disease detection, harvesting robotics, and variable rate nutrient applications, and have raised $5.2 billion to date. The top 20 are shown in Figure 1 above, excluding the outlier and more generalist agtech firm, Trimble.

Most computer vision equity investment to date has gone into chemical weed control, where leaders include Trimble, Verdant Robotics, Blue River Technology, Greeneye Technology and Niqo Robotics.

Such companies say they can reduce applications of weedkillers by 90% or more, by substituting field-level broadcast for targeted applications.

When we caught up with Greeneye Technology CEO, Nadav Boucher, 12 months ago, on the New Food Finance podcast (see below), he said the company was poised to roll out commercially in the U.S. Mid-West. He calculated paybacks of 18 months on his sprayer retrofits, assuming farm holding sizes of 4,000 acres.

According to the USDA, the average U.S. farm size in 2021 was 445 acres. Not surprisingly, Greeneye is targeting early movers among bigger farms with the resources to invest, and the scale to capitalise on savings.

But what about mass adoption, including in countries with much smaller average farm sizes, in a global fragmented market composed of millions of small farm businesses, where the FAO estimates that three-quarters of farms worldwide are family-run?

When these technologies hit mainstream will depend on how the economics stack up. Hurdles include the capital-intensive nature of investments, and a slow accrual of profits to uncertain annual harvests, made high-risk by external factors, and not least, the weather.

Smart policies will help, where the UK may provide an early example. For the first time, later this year, the UK will introduce payments for precision farming actions, under its Sustainable Farming Incentive scheme, where farmers will be paid for using computer vision tech to make variable rate applications of nutrients and herbicides (at £27 to £43 per hectare per year).

Such payments will help small businesses and tenants, who often use contractors, to cover the higher cost of precision ag operations, and are a good example of how this UK scheme is bringing innovation to ag policy.