How investable is regen ag?

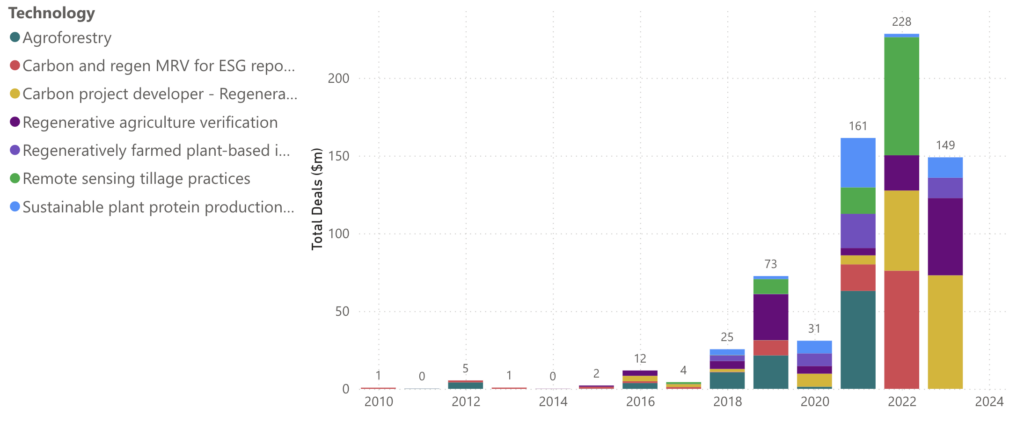

Figure 1. Cumulative investment in “regen ag” themes

Regenerative agriculture is gaining popularity, as a way to cut the farm-level environmental impact of food production, and while its prescriptions are sometimes vague and voluntary, technology themes are emerging that are attracting investors.

Regen ag is a more pragmatic alternative to organic farming, for example encouraging farmers to minimise – rather than eliminate – the use of chemicals, as well as to plough the soil less, and plant cover crops, to increase soil carbon and organic matter.

Regen ag principles are expressed through a set of guidelines, rather than firm prescriptions, and as such have raised some criticism, for example that major food producers use it as a buzzword, to greenwash their supply chains.

Nevertheless, the theme is attracting agtech companies and investors.

At New Food Finance, we have created a database of low environmental-impact agtech and foodtech companies, showing how these are emerging as a sector within agri-food, as renewables have emerged within energy, driving a global, economy-wide, green transition.

A simple word search for “regen ag”, across our database of 3,200 companies, indicates fund-raisings worth some $3.1 billion, by 73 companies. Here we are reviewing technologies that directly reference regen ag, thus excluding indirect themes that contribute hugely, such as Integrated Pest Management.

Digging deeper, some bigger regen ag themes include: advisory services; monitoring reporting and verification (MRV); carbon project development; and sustainable sourcing of regeneratively farmed food, including plant-based protein ingredients (see Figure 1 above).

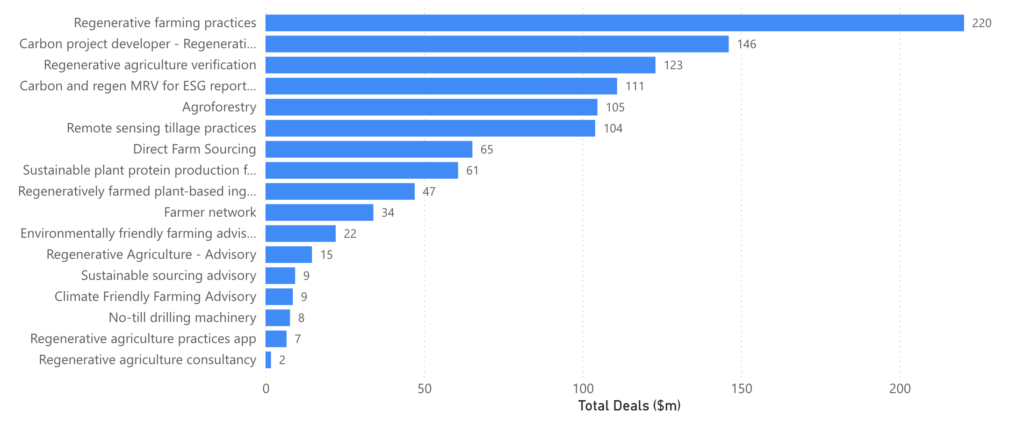

We also filter the fastest growing of these regen ag themes, see Figure 2 below, where compliance and MRV-based companies are notable.

We summarise some of our main regen ag themes as follows:

Regenerative farm practices: these are food producing companies that say they apply regen practices, such as U.S.-based Materra Farming (raised $63 million to date), which produces nuts, citrus, tomatoes and forage crops, using regenerative practices where possible.

Sourcing of food produced using regenerative practices – these are food processing or retail companies that source exclusively from farms that use regen ag practices, such as Australia’s Wide Open Agriculture ($47 million), which describes itself as a regenerative food and drink company, spanning grass-fed beef and lamb, and oat and lupin-based proteins, derived from regeneratively farmed crops.

Carbon project developers – many companies are emerging that help farmers generate carbon credits, usually for soil carbon sequestration, in return for implementing regen ag practices, such as Seattle-based Nori ($20 million).

Regen ag verification – these are companies specialising in verifying regen ag practices, whether to support the generation of carbon credits, or to help food companies improve their supply chains, such as Regrow ($104 million).

Regen ag advisory: many companies are providing regen ag advisory; some are taking an agtech approach, for example Germany’s Klim ($6.6 million), which supplies farmers with a smart device app to track their regen ag practices.

Figure 2. Annual investment in high-growth “regen ag” themes