Designer fats outshine alternative proteins in 2024

Chart of the Week – Designer fats outshine alternative proteins in 2024

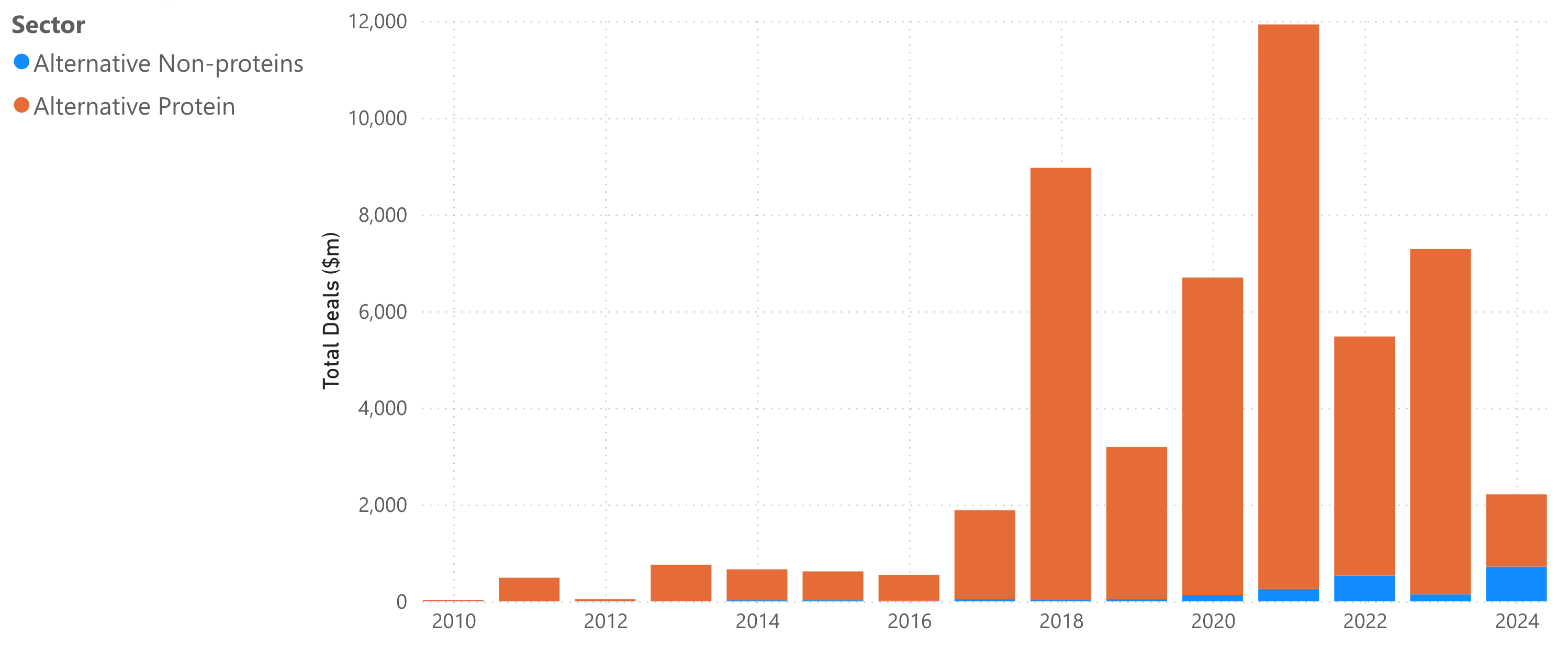

Alternative fats and other non-proteins are outshining alternative proteins in 2024 so far, show New Food Finance data, which tracks investment and investment growth.

Designer fats, and other non-proteins, which our taxonomy refers to as “alternative non-proteins”, target more sustainable production methods, often in a lab-based environment, of products including lab-made palm oil, animal fat substitutes, fatty acids like omega-3, as well as alternative coffee, cocoa and sugar.

This non-proteins sector is still far smaller than the better known alternative protein sector, which includes plant-based, cultivated and fermented meat and dairy substitutes.

The non-protein sector uses similar production technologies, such as cellular cultivation, fermentation and molecular farming. While still much smaller, it has grown much faster than alternative proteins this year, and has already posted a record-breaking year, as of July.

Examples of investments this year, by production technology, include:

Cultivation – Cultimate says it uses modern cellular agriculture technologies to grow animal fat cells without involving animals ($2.5 million raised in April)

Fermentation – C16 Biosciences says it is developing a fermentation-based palm oil alternative ($3.5 million in January)

Plant-based – Time Travelling Milkman says it uses European sunflower seeds to replace tropical plant-based fats, such as palm oil, for plant-based dairy products ($0.9 million in March)

Waste-based – NoPalm says it ferments agri-food waste streams into tailor-made oils and fats ($5 million in July)

Molecular farming – Miruku is a startup in molecular farming, that has developed a ‘dairy seed system’, where it produces dairy proteins and fats within the seeds of oil seed row crops ($5 million in Feb.)

New Food Finance: Sign up for a 7-day free trial

“Green Transition” Deals of the Week

United States, July 26 ($15m) – Verde Farms – Distributor of grass-fed, free-range beef produced with no hormones or antibiotics, from a network of family farmers in Uruguay, Australia, and North America, was acquired by Manna Tree.

United States, July 25 ($30m) – InnerPlant – Developing a variety of genetically-engineered plants that signal when they’re stressed, through fluorescence in different colours, serving as an early warning system for growers.

Portugal, July 25 ($18m) – Oceano Fresco – produces clams in hanging nets in the open ocean off the coast of Portugal, using zero inputs.

France, July 25 ($29m) – Micropep – Developing micropeptide solutions, including biofungicides and bioherbicides, to help adapt agricultural systems to the impact of climate change.

Netherlands, July 25 ($5m) – NoPalm says it ferments agri-food waste streams into tailor-made oils and fats.

Australia, July 25 (undisclosed) – Argyle Group – Purchases and leases back water entitlements from Australian farmers that use irrigation, in catchments with capped agricultural water use.

United States, July 25 ($133m) – Monarch Tractor – Producer of an electric, self-driving tractor for repetitive tasks especially in perennial crops and orchards.

United States, July 24 (Undisclosed) – Uproot – producer of oat, pea and soy-based milk was acquired by Califia Farms.

Denmark, July 24 ($4.3m) – Agrobiomics – Aims to make agriculture resilient to climate change by providing transformative biological solutions in the form of biostimulants.

United States, July 24 ($2.5m) – Farmblox – Developer of monitoring system for maple tree farming, measuring sap or water tank fullness, for insights on leaks, sap yield and crop watering needs.

Spain, July 23 ($2m) – Widhoc Smart Solutions – Provider of a wide range of monitors for irrigation optimisation, to prepare irrigation reports and recommendations.

United States, July 23 ($3m) – Mitti Labs – Describes itself as a digital monitoring reporting and verification (dMRV) company, which develops registry-compliant projects, focused on high-quality sustainable rice projects to reduce methane emissions.

Australia, July 23 ($3.5m) – ExoFlare – Has developed a Biosecurity Threat Management Platform, which provides accelerated detection, response and recovery from biothreats across the agriculture and food supply chain.

United Kingdom, July 22 ($49m) – GrowUp – Operator of a UK-based vertical farm.

Spain, July 22 (Undisclosed) – Frias Nutricion – Producer of dairy substitute drinks from hazelnut, oat and soy.

What We’re Reading

Globo.com (July 29) – Direct planting will be applied in organic production in Paraná

TheAgriBiz (July 29) – How Raduan Nassar’s farm became a laboratory for regenerative agriculture

Warp News (July 28) – Food begins to be produced from air and solar power

TheAgriBiz (July 26) – Why Fama’s activist fund invested in SLC

Green Queen (July 26) – Malaysia to Conduct Cultivated Meat Research to Bolster Agtech Sector & Food Security

FoodNavigator (July 26) – MarineBiologics dives into macroalgae functionality with ingredient platform

Green Queen (July 24) – Creamilux: Dairy GiantFonterra to Use Nourish Ingredients’ Animal-Free Fat in New Products