Fund-raising deals: fewer and longer

Chart of the Week – Fund-raising deals: fewer and longer

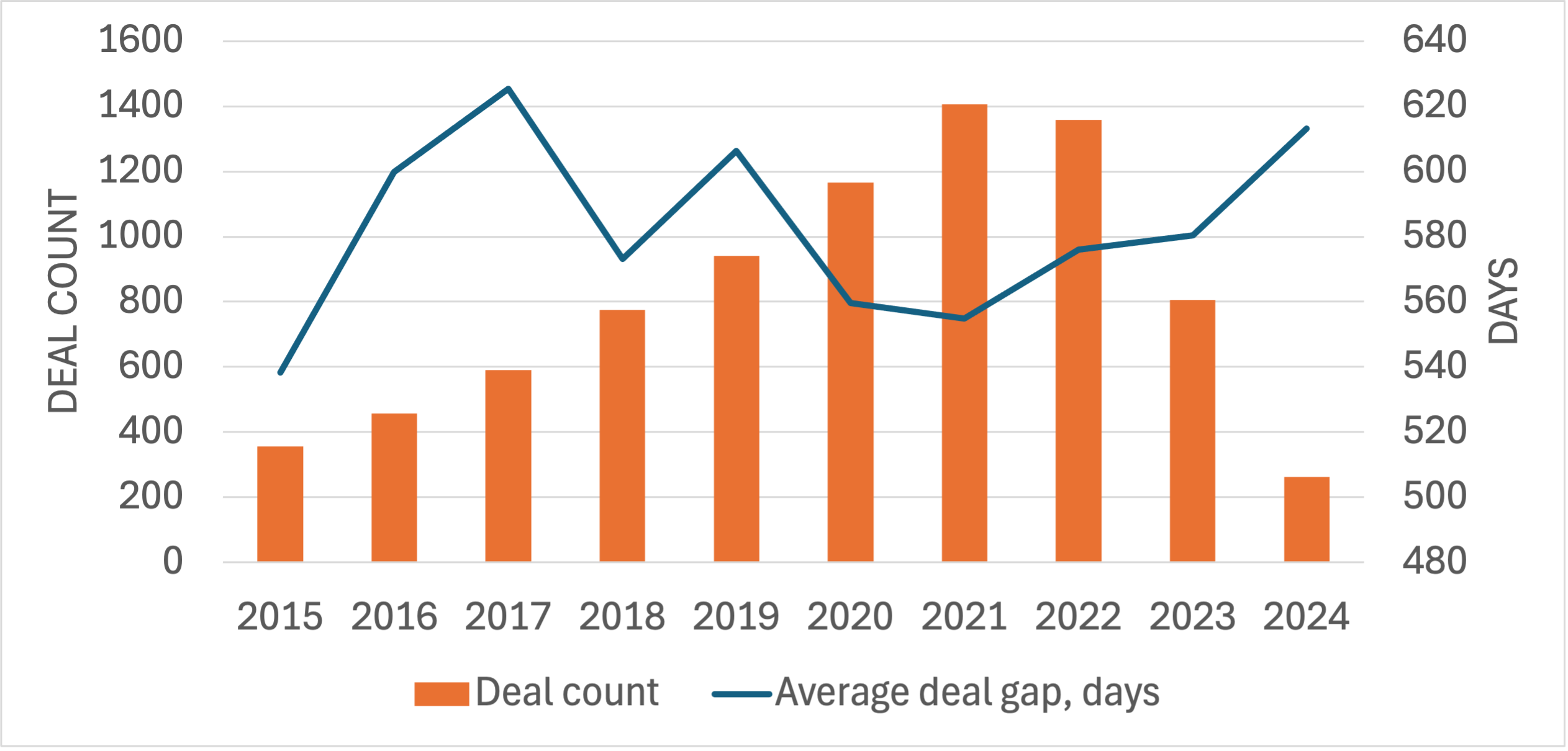

Agri-food funding deals in the “green transition” space are taking longer to arrange, in line with venture capital fund-raising across the global economy, reaching a new high since 2017, so far this year, New Food Finance Data show.

Gaps between deals are up slightly, now on average 613 days, versus 580 days last year, and 625 days in 2017. But deal counts are on track to be significantly lower this year, at just 263 deals as of mid-August, versus 805 for all of last year. In other words, the fund-raising slowdown is being felt more in a failure to agree deals at all.

The slowdown is blamed mostly on higher interest rates, which have raised company costs and lowered valuations, depressing returns for funders.

At New Food Finance, we have tracked more than 3,300 companies directly focused on developing environmentally friendly products and services, in food production. We have classified these companies according to more than 1,700 sectors, markets and technologies, and recorded every related company-level fund-raising and M&A transaction, or $150 billion of deals in total.

New Food Finance data show that companies in the robotics and carbon & nature sectors have the shortest gap between deals, at 463 days and 443 days respectively, to date.

Two of the biggest deals this year in these two sectors are:

- Monarch Tractor (Robotics) – Producer of an electric, self-driving tractor for repetitive tasks especially in perennial crops and orchards. Monarch Tractor raised $133 million last month, aiming for sales expansion for its all-electric, autonomous machines.

- SunCulture (Carbon & Nature) – Offers off-grid solar technology solutions for irrigation, integrating solar water pumping and drip irrigation technology. SunCulture raised $27.5 million in April, to expand its IoT-enabled solar powered irrigation offering to smallholder farmers.

New Food Finance: Sign up for a 7-day free trial

“Green Transition” Deals of the Week

Belgium, Aug 15 ($2.19m) – HEDERA-22 – Hedera-22 is seeking to use its library of soil bacteria, or actinomycetes, and Al-based screening of these, to seek new biomolecules of interest, including through genetic modification. The company expects applications in crop protection products, as well as bacterial fermentation.

United Kingdom, Aug 13 ($2.5m) – Adamo – Producer of beef steak substitutes through fungi fermentation. The UK startup has raised $2.5 million in a seed funding round co-led by the UK Innovation Science and Seed Fund (UKI2S) and Joyful Ventures.

United States, Aug 13 ($3.5m) Terrantic – Terrantic is a digital supply chain company which says its software integrates with other existing enterprise resource planning (ERP) systems, to enable better productivity, traceability, and reporting across a business. The goal of its end-to-end system is to serve as the single source of data for all operations, including inventory, financials and other data sources.