European Agri-Chemical Green Investment Under Threat

Chart of the Week – European Agri-Chemical Green Investment Under Threat

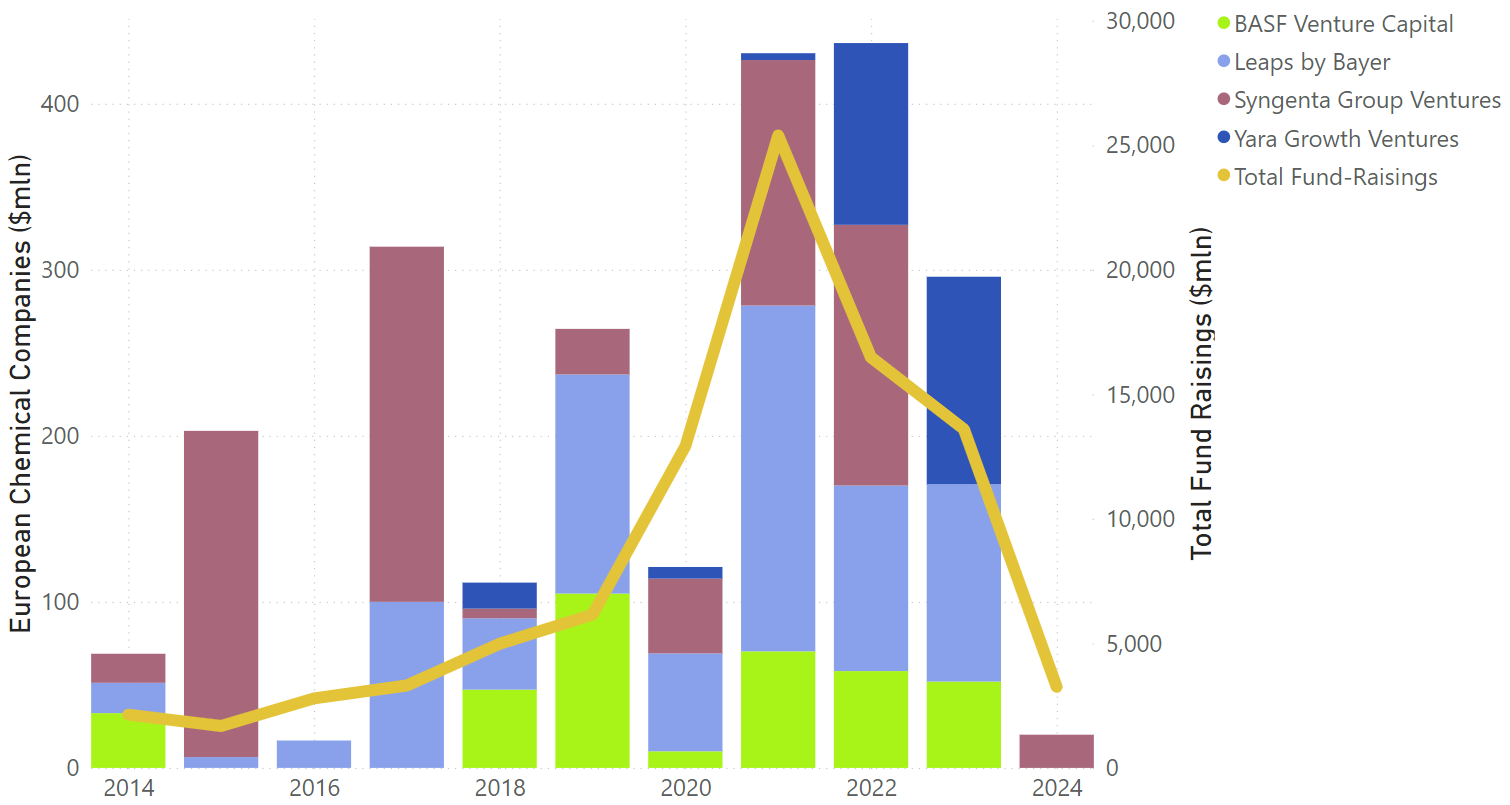

Investment by Europe’s biggest agri-chemical companies in “green transition” start-ups outperformed the global space through 2023, but has since followed a more general crash downwards in 2024 to date.

The four big European agri-chemical companies, Bayer, BASF, Yara and Syngenta, all have venture capital arms, which invest strategically in start-ups positioning for disruptive change, including tougher environmental regulation in their home European market.

At New Food Finance, we track companies developing technologies for a more sustainable food system, to reduce emissions, pollution and biodiversity loss.

The EU this year watered down its flagship “Farm to Fork Strategy”, significantly pulling its goal to halve pesticide use by 2030. While the direction of travel is clear, the EU’s swerve risks blunting a sector transition.

The chart above shows how equity investment in green transition startups by some of Europe’s biggest agri-chemical companies held up post-Covid, but has followed global investment sharply downwards, in 2024.

Some of the biggest recent deals by these investors include:

- Both BASF Venture Capital and Yara Growth Ventures participated in a $52 million funding for Swiss AgTech company, Ecorobotix, to accelerate growth of its precision smart sprayer system (May 9 2023).

- Leaps by Bayer took part in a $45m fund-raising for U.S. ag biotech startup NewLeaf Symbiotics, to support its “new class of microbial amendments” for row crops, in December 2023.

- Syngenta Group Ventures participated in a $20 million funding for Israel-based precision agtech company Greeneye Technology, to scale up operations in the U.S., in April 2024.

New Food Finance: Sign up for a 7-day free trial

“Green Transition” Deals of the Week

Singapore, Aug 22 – DiMuto ($5.9M) – DiMuto secured US$5.9m to boost its agri-food chain traceability solution. The company says it is an AI-driven trade management solution, built by traders for traders, providing visibility across all flows of money, goods and services.

Germany, Aug 22 – Root Global ($8.89M) – Root Global helps companies achieve Net Zero by collecting emissions data across the agricultural supply chain. Its on-farm emissions calculator measures Scope 3 emissions, helping companies establish a carbon footprint baseline, and ensuring compliance with EU sustainability regulations. The company secured €8m for its climate footprint management solution.

United Kingdom, Aug 20 – Tofoo (Undisclosed Amount) – The Tofoo Co., which describes itself as the UK’s No. 2 Meat-Free Brand, was acquired by Comitis Capital for an undisclosed sum. Tofoo retails organic tofu in UK supermarkets, following a Japanese recipe of non-GM soybeans and nigari. It says the tofu is pasteurized, organic, and sustainably produced.

What We’re Reading

Canal Rural (Aug 28) – Brazil needs to expand environmental policies for COP30, finds study

Financial Times (Aug 23) – Pink rice serves up alternative to carbon-intensive meat

Globo Rural (Aug 23) – Brazil and the opportunity to lead transformations in agribusiness

Fusões&Aquisições (Aug 23) – BTG fund sells stake in Fazenda Futuro

TheAgribiz (Aug 23) – No borders: Husqvarna buys InCeres to create smart machines

TheAgribiz (Aug 22) – Scheffer sets foot in commercial production of biologicals

TheAgribiz (Aug 22) – The organics boom continues: Biotrop triples production capacity

Financial Times (Aug 22) – The global power of Big Agriculture’s lobbying