Precision ag and IPM lead agri-food start-up survivors

Chart of the Week – Precision ag and IPM lead agri-food start-up survivors

Precision ag and integrated pest management companies are among the great survivors of a brutal VC funding environment, New Food Finance data show, after including some of the smallest companies, which often fade silently and unannounced.

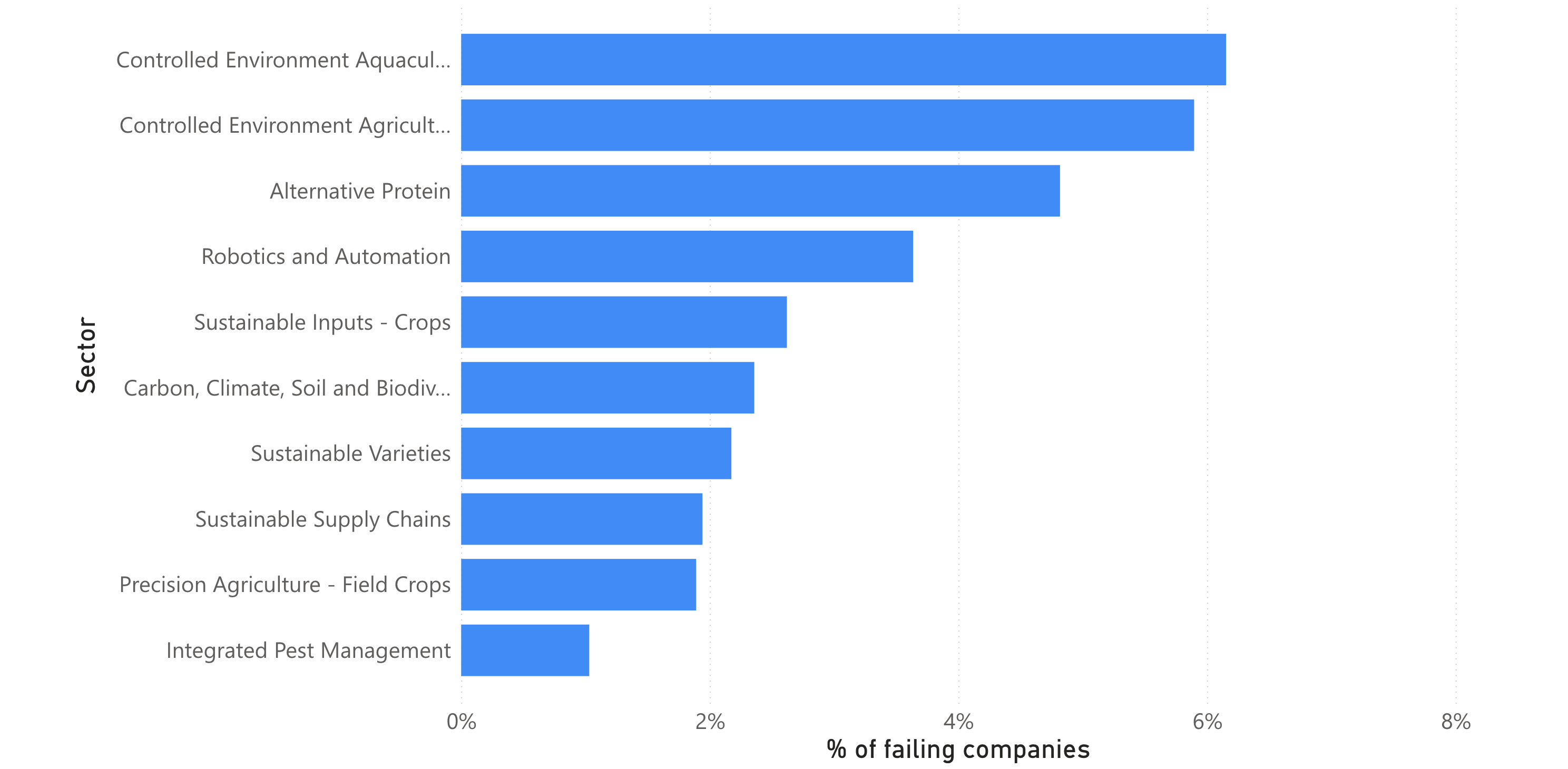

Our Chart of the Week above shows that indoor farming companies – both “controlled environment” agriculture and aquaculture – have up to six times higher failure rates, in a ranking of our 10 biggest sectors.

We define failure not only according to publicly announced bankruptcies, but also “website down” companies, which we reviewed across our entire database at a 10-week interval to filter out temporary web issues.

These companies emerge as a leading indicator of company failure. They were all reviewed in the past two months, but their distribution by sector closely matches announced bankruptcies over the past several years.

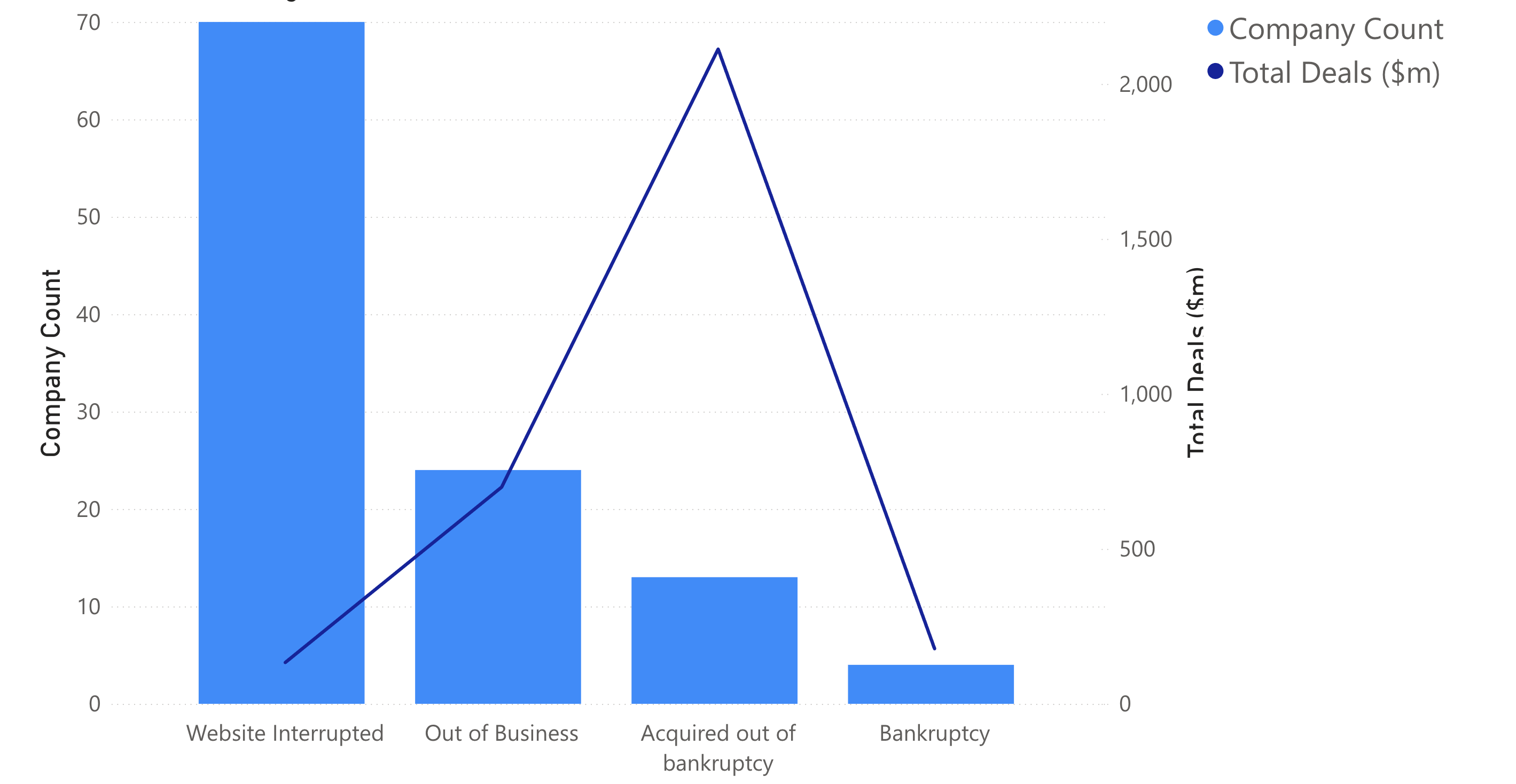

We find that while “website down” companies accounted for the most failing companies, they had also raised the least funds, as a relatively silent cohort of smaller firms. Among our four categories of failing companies, those that had raised the most money, and therefore perhaps had most value, were also those that were acquired out of bankruptcy, highlighting how all value is not lost (Chart below).

At New Food Finance, we track companies, investors and deals driving a “green transition” in food production.

Some recent acquisitions out of bankruptcy include:

Wide Open Agriculture’s acquisition of Germany’s sweet lupin protein producer, Prolupin, for €2.5 million (Oct. 2023).

The acquisition by Sandton Capital Partners and Lactuca Holdings LLC of the vertical farming assets of Kalera (Oct. 2023).

The launch by agrifoodtech investor, Big Idea Ventures, of Bayou Best Foods, a new company in the plant-based seafood space, using IP from the alt-shrimp startup New Wave Foods, which had ceased operations (July 2024).

The acquisition of Mycorena by VEOS Group (Aug. 2024)

New Food Finance: Sign up for a 7-day free trial

“Green Transition” Deals of the Week

Last week saw six fund-raisings worth $25 million, and one M&A deal, in our “green transition” space.

United States, Aug 29 – HabiTerre ($10M) – HabiTerre specialises in the quantification of soil organic carbon (SOC) and greenhouse gas (GHG) emissions, to inform and predict environmental and productivity performance. John Deere led a $10m Series A first close to help the company to develop its sustainability metrics.

Australia, Aug 29 – Inform Ag ($4.76M) – Inform Ag says it supports farm operations management, monitoring, and automation solutions, with the goal of empowering agricultural enterprises to make data-driven decisions. Inform Ag secured €4.8M to support its goal for future proof farming.

United Kingdom, Aug 30 – Nandi Proteins Ltd ($0.66M) – Based in Edinburgh, Nandi Protein was founded in 2001 as a spin-out from Heriot-Watt University to develop innovative protein-based ingredients. The company raised €0.7M to develop egg white alternatives.

Canada, Aug 28 – New School Foods ($6M) – A maker of whole-cut, plant-based salmon using proprietary muscle fibre and scaffolding technologies. The company landed $6M from IKEA and Global Investors to scale production.

Sweden, Aug 29 – Nordic SeaFarm ($2.33M) – A cultivator, harvester and distributor of kelp for alternative protein and crop nutrition, Nordic SeaFarm gained $2.3 million backing from EIT InnoEnergy and Inter IKEA Group to advance its seaweed-based solutions and R&D.

United States, Aug 29 – Pattern Ag ( Undisclosed ) – Pattern Ag says it detects the most damaging pests and pathogens in a field, and uses this data to predict the biggest threats to farm operations. The company completed a merger of equals with EarthOptics. EarthOptics is a soil data measurement and mapping company.

United States, Aug 26 – The Better Meat Co. ($1.4M) – The company is a producer of mycoprotein by fermentation, from plant-based feedstock such as potatoes, for food companies to make meat substitutes. The U.S. Defense Department backed the company with $1.4M, for advanced biotech development.

What We’re Reading

The Guardian (Sept 4) – Europe’s farming lobbies recognise need to eat less meat in shared vision report

The Guardian (Sept 3) – ‘A drizzle, a dollop and a crunch’: the secret to plant-based eating

Global Methane Hub (Aug 31) – Enteric Fermentation R&D Accelerator Program Strategy

Canal Rural (Aug 31) – Fires reduce soil quality and increase production costs

Canal Rural (Aug 28) – Global food transformation: B20 proposes strategies for a sustainable future