UK incentives halve payback periods for robotic sprayers

Chart of the Week – UK incentives halve payback periods for robotic sprayers

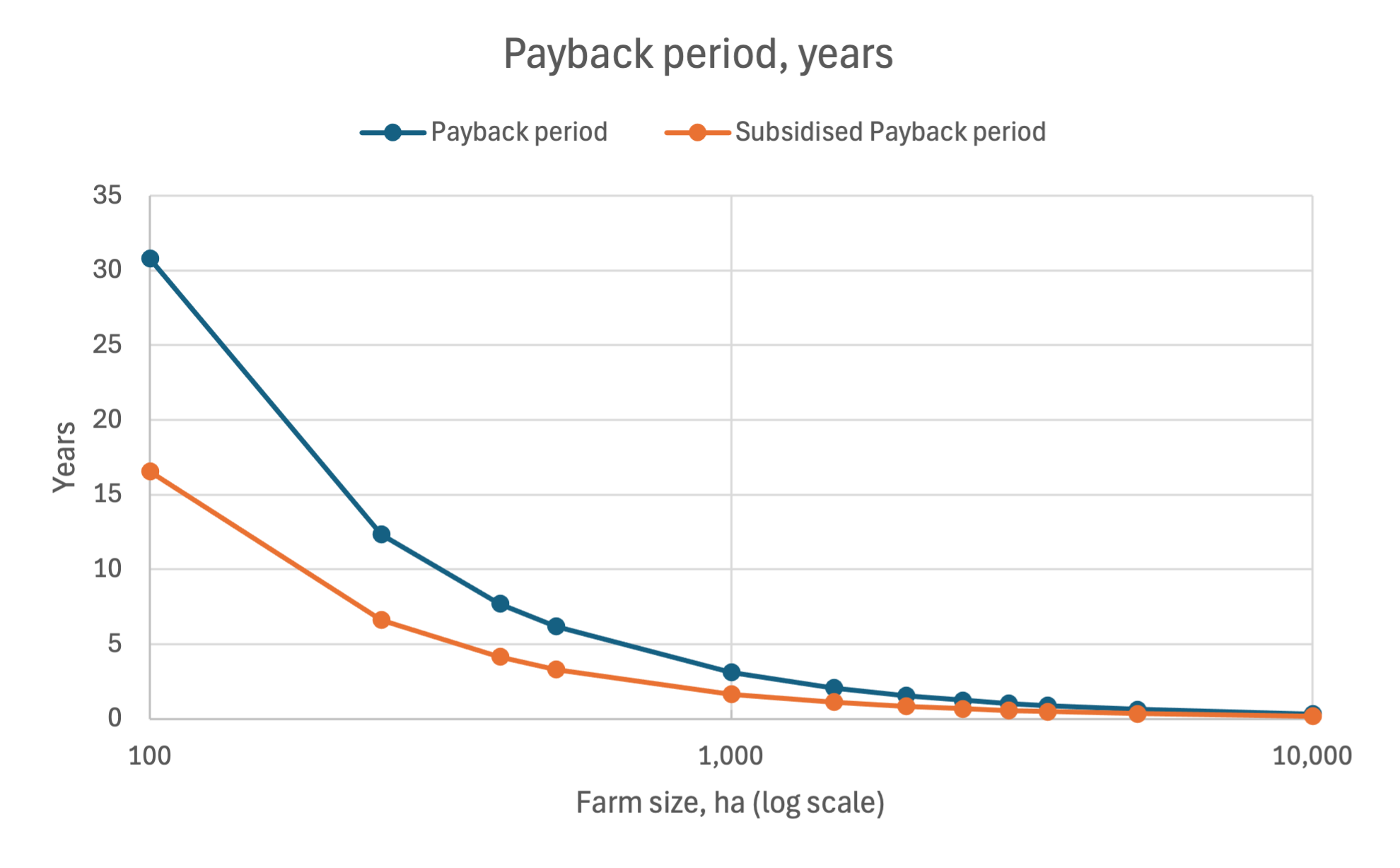

New UK incentives almost halve the payback period on more environmentally friendly, high-tech sprayers, in a promising example of how the country’s imminent, farm subsidy overhaul will boost green technologies, New Food Finance analysis shows.

On the down side, however, our Chart of the Week above shows that payback periods are still excessive for smaller farm sizes, at 20 months, subsidised, for a 1,000 ha holding, while most systems do not yet apply to a typical UK crop rotation.

Britain is in the midst of a farm subsidy overhaul, after its exit from the European Union, replacing area payments with incentives for environmental actions, now taking shape.

We take the example of payments for precision ag equipment, and drill into payments for use of automated herbicide sprayers.

The UK will pay £43 per hectare for sprayers that recognise weeds within growing crops, and automatically switch on or off individual spray nozzles, to target these, in real time.

Such sprayers can deliver an ongoing cost saving and environmental benefit, as a result of lower herbicide use. The exact saving is hard to estimate, given it depends on factors such as a farmer’s individual propensity to spray, as well as the crop rotation, weed pressure, and size of farm.

Economic analysis is also complicated by –

The diversity of pricing approaches, from a per acre or per day fee, to a one-off capital cost

The diversity of systems, from retrofits to integrated sprayers

The range of technologies, from recognising weeds on bare soil (green on brown) to a more advanced green on green differentiation within the crop

The limitation of “approved crops”, with some producers limiting their systems to corn, soy and cotton (a typical UK arable rotation is wheat, barley and rape)

The immaturity of the industry, only just hitting commercial scale, making list prices hard to find

We make some simplified estimates, within the publicly available data, to assume a one-off cost premium of $200k, and a 50% herbicide saving, equivalent to £50 ($65) per hectare per year.

Our chart of the week shows that the UK incentive is effective, almost halving payback periods, but these are still prohibitively high for most farm sizes.

Companies presently developing these systems include:

Blue River Technology – Acquired by John Deere for $305m

Carbon Bee – private company

Exxact Robotics – subsidiary of Exel Industries

Greeneye Technology – $66m fund-raising to date

Niqo Robotics – $23m fund-raising to date

One Smart Spray – JV between Bosch and BASF

New Food Finance: Sign up for a 7-day free trial

“Green Transition” Deals of the Week

In our “Green Transition” space last week, we saw three fund-raisings worth $18 million, and two M&A deals:

Brazil, September 5 – Cellva Ingredients ($1.5 million) – Cellva Ingredients, a biotech startup from Brazil, uses cellular cultivation and microencapsulation techniques to create GMO-free, animal-free food ingredients. ProVeg Incubator, Rumbo Ventures, AIR Capital, Fundepar, and EA Angels led a $1.5 million funding round to help the company develop sustainable alternatives to animal fats.

United States, September 5 – Climax Foods (Undisclosed Amount) – Climax Foods, based in California, is innovating in plant-based foods to make alternatives indistinguishable from animal-based products. The company secured funding through a debt round (amount undisclosed).

Belgium, September 5 – Soil Capital ($17 million) – Soil Capital, a Belgium-based company, develops soil carbon projects to help arable farmers increase carbon sequestration through sustainable practices. They raised $16.67 million from Trill Impact, Ring Capital, Sandwater, SFPI-FPIM, and Santander.

United States, September 3 – Motif FoodWorks (Undisclosed Amount) – Motif FoodWorks, based in Boston, United States, is developing plant-based burgers using novel ingredients and precision fermentation. Impossible acquired the company’s heme business, to resolve a long-running legal dispute.

Australia, August 28 – Australian Food & Agriculture Company ($529 million) – Agriculture & Natural Solutions Acquisition Corporation, backed by Riverstone, bought the Australian Food & Agriculture Company Limited, in a deal valued at A$780 million, showcasing the opportunities in regenerative ag market in Australia.