Precision Fermentation Nears Milk Protein Disruption

Graphic of the Week – Precision Fermentation Nears Milk Protein Disruption

Precision fermentation may be poised to disrupt key agri-food markets, extending successes in high-end uses for human medicine, by using microbes to create animal-free proteins, where precision fermented (PF) milk has the largest near-term potential.

New Food Finance data show that PF milk protein companies have raised $1.8 billion cumulatively to date, with 2024 so far double last year, a significant achievement in the present market.

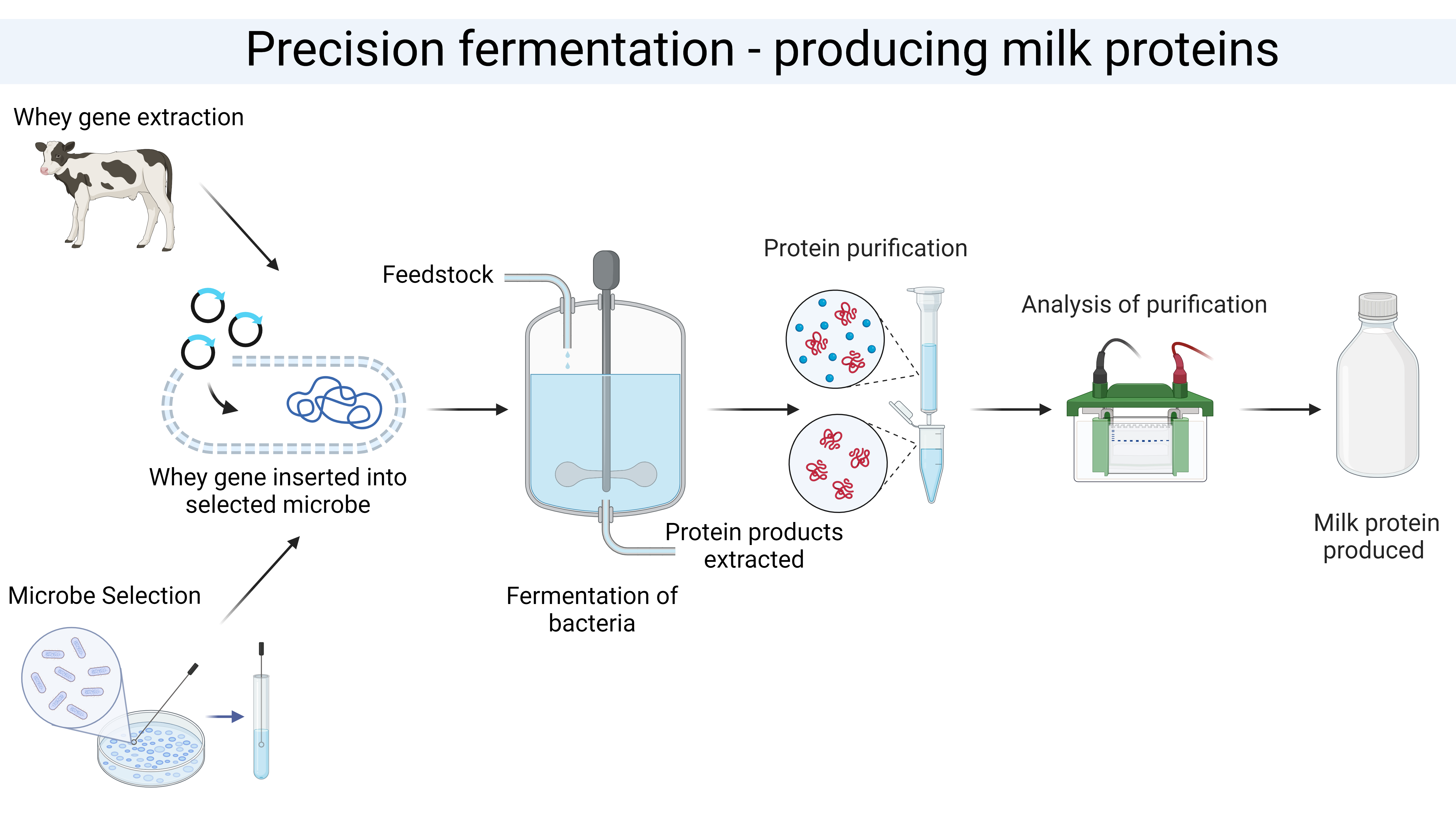

Precision fermentation involves introducing a specific gene from one organism into a microbe that can then produce the coded protein. The process has been used in medicine for many years to produce essential drugs like insulin: the gene for insulin is taken from humans, and inserted into yeast, which is then fermented to mass produce an exact replica of human insulin, for type 1 diabetics.

In the case of conventional milk, there are three key proteins, each with their own uses, which PF start-ups are aiming to disrupt:

Whey makes up about 20% of milk proteins.

It can be used as a protein supplement, and is added to foods to boost their nutritional profile. Whey is a complete protein, containing all nine essential amino acids, and is very bioavailable, meaning it is quick to digest and absorb.

One company producing PF whey protein is Perfect Day.

Some PF whey protein products are becoming available, in time-limited trials. Nestle brand, Orgain, states that its PF whey powder has now been discontinued, but was retailing at $2.25 per ounce ($7.95 per 100 grams). A random internet search indicates whey isolate from conventional dairy retails at around $2.50 to $4 per 100 grams.

Casein accounts for about 80% of cow’s milk proteins.

Casein forms micelles, which give milk its white colour. It is an emulsifier, enabling oils and fats to mix in water in milk. It is used in cheese spreads, and is the protein that gives vegan cheese its stretchy texture and melt.

New Culture produces PF casein to create vegan cheese with an authentic taste and texture. The company says its cheese is not yet available for sale.

Lactoferrin is found in cow’s milk, but in much higher quantities in human milk.

Lactoferrin is part of the whey protein family. It is a key ingredient in human baby formula, as it supports the baby’s immune system, and improves gut health. Lactoferrin is only found in very small amounts in cow’s milk, making extraction expensive and limited.

Harmony Baby Nutrition produces human lactoferrin using precision fermentation. Another company, Helaina, recently raised $45 million to launch a baby formula.

PF proteins often require regulatory approval, because their production process is classed as novel, using genetically modified microbes, with no history of consumption prior to the benchmark year of 1997, according to the definition of “novel food” in Britain and the European Union.

Following is a summary of the state of play, in selected countries:

The U.S. FDA (Food and Drug Administration) has granted GRAS (generally recognized as safe) status to companies like Perfect Day. Individual companies apply for GRAS status, with approval relating to the specific product.

In the European Union, products must undergo a detailed safety assessment under the Novel Food Regulation, and the EFSA (European Food Safety Authority). To date, only two companies have submitted applications for PF dairy proteins, Perfect Day and Remilk, both awaiting final approval.

Australia and New Zealand are in the process of reviewing similar applications through FSANZ (Food Standards Australia New Zealand).

In India, the government has started framing regulatory guidelines for alternative protein. The FSSAI (Food Safety and StandardsAuthority of India) has granted pre-market approvals to certain companies, including Perfect Day, for mycoprotein and precision fermentation-derived non-animal whey protein.

Singapore has proven a leader in approving novel food technologies, for example approving TurtleTree’s precision fermentation-derived lactoferrin.

Product Launch: Deep Dive Briefings!

New Food Finance last week introduced a new feature for platform subscribers, a forthcoming series of fortnightly Deep Dive Briefings.

Each briefing will give the low-down on an emerging technology which is up-ending food production, providing top company exponents, and fund-raising trends. Subscribers to our platform will receive the briefings first, directly to their email.

Check out our first two briefings, on Genetic Manipulation and Protein-based Biological pesticides!

New Food Finance: Sign up for a 3-day free trial

“Green Transition” Deals of the Week

In our “Green Transition” space last week, we saw fundraising worth over $124 million.

October 17 – Agtonomy develops electric, self-driving tractors for specialty crops, handling tasks like mowing, spraying, and weeding. The company raised $10 million in venture capital from Autotech Ventures, Rethink Capital Partners, Allison Transmission, Toyota Ventures, Flybridge Capital Partners, Cavallo Ventures, and Black Forest Ventures.

October 17 – Biotalys has developed protein-based biological pesticides, including biofungicides, bioinsecticides, and biobactericides. Biotalys raised $16.24 million through public markets, with support from Ackermans & van Haaren, Agri Investment Fund, and ASR Vermogensbeheer NV.

October 17 – Viridian Renewable Technology has created an end-to-end solution for large-scale production of insect-based ingredients using Black Soldier Fly Larvae, serving the pets, livestock, and horticulture sectors. The company raised $1.67 million in venture capital from Breakthrough Victoria to scale its production of insect-based solutions.

October 16 – Liberation Labs is building large-scale precision fermentation facilities to reduce costs, increase yields, and improve process efficiency for novel bioproducts. The company raised $3.5 million in debt financing from Agronomics, New Agrarian Company, and Jim Mellon.

October 16 – Sallea is working to overcome the limitations of cultivated meat production, specifically in creating whole cuts. The platform customizes cell-growth scaffolds to adjust size, texture, and nutrition for cultivated whole cuts of meat and fish. Sallea raised $2.6 million in pre-venture capital from Founderful and Kost Capital.

October 16 – Voyage Foods produces cocoa-free chocolate substitutes, including spreads and milk drinks, using sustainable ingredients like shea kernel oil and grape seeds. The company raised $25 million in debt from the U.S. Department of Agriculture.

October 15 – Basecamp Research combines a “foundational dataset” with AI to create the world’s largest biological database, allowing deep learning models to design genomes and proteins. The company raised $60 million in venture capital from S32, True Ventures, Redalpine, Hummingbird Ventures, and Singular.

October 15 – Blue Radix provides algorithm-based solutions for autonomous management of smart greenhouse systems, including energy, climate, CO2, and irrigation. Blue Radix raised $5.44 million in venture capital from Navus Ventures and Horticoop.