The Traceability Opportunity from Looming Trade Disputes

Chart of the Week: The Traceability Opportunity from Looming Trade Disputes

A spat last week over a long-awaited EU-South American trade deal, on the heels of lobbying by commodity exporters to delay the European deforestation regulation, highlights the opportunity for food traceability specialists to smooth disputes by proving the environmental provenance of imports.

In October, the European Commission postponed the EU Deforestation Regulation (EUDR), which aims to ensure EU products and imports don’t contribute to deforestation, after lobbying by exporters such as Indonesia and Malaysia.

Separately last week, the CEO of French retail giant Carrefour, Alexandre Bompard, committed not to sell South American beef in France, on French farmer fears that a proposed free trade agreement between the European Union and Mercosur region, negotiated since 1999, would flood the French market.

The Group immediately backtracked, after a backlash threatened Carrefour Brazil, the company’s largest market outside France.

Traceability service companies can overcome these disputes, fears and risks, by providing much-needed transparency. They can provide “feedback loops”, for example, for growers to confirm their field boundaries, and local verifiers to confirm these, alongside related land use history including deforestation, filling gaps in digital mapping and land use in exporting nations.

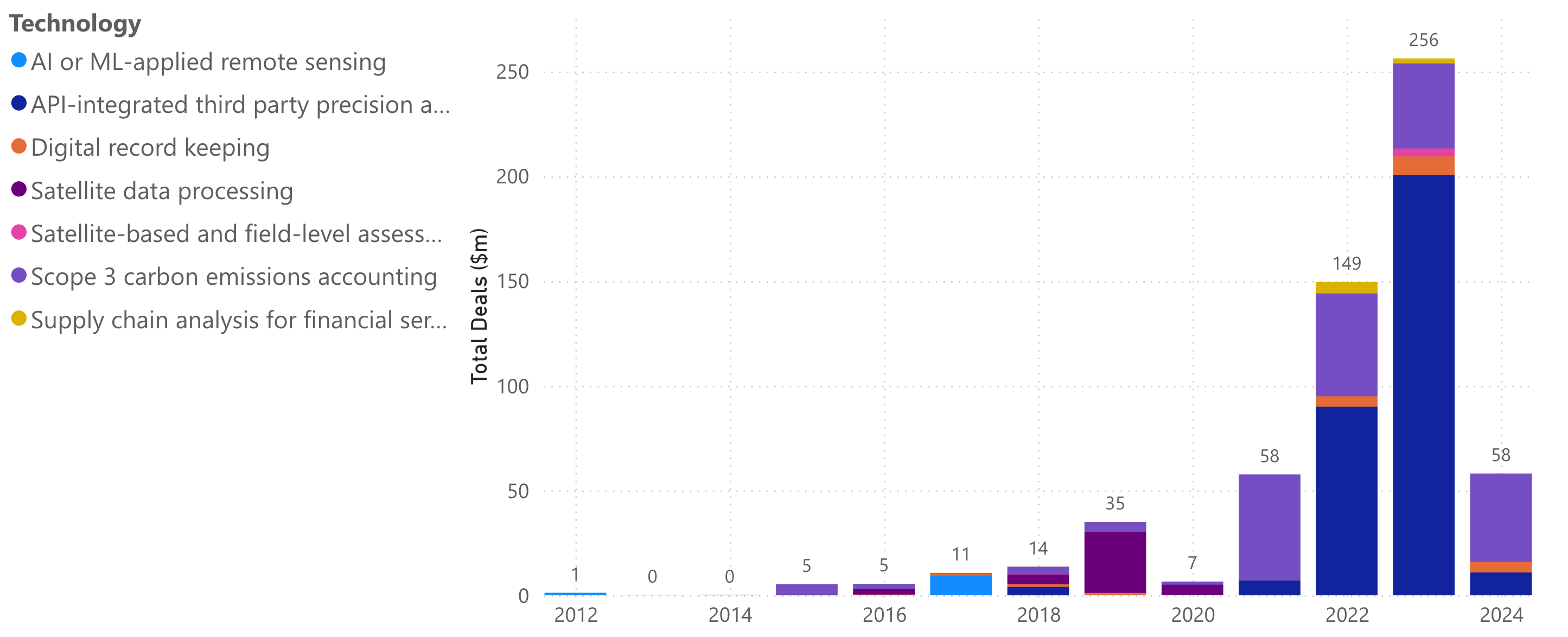

At New Food Finance, we track deals and prices defining a “green transition” in food and ag. Our fund-raising platform shows that “Supply Chain MRV” is a significant growth theme (see Chart of the Week above), raising more than $600m to date.

We find 12 Brazil-based traceability companies, leveraging technologies such as blockchain and QR-codes, to enable distributed digital record-keeping, working with groups including Carrefour, JBS, GPA and Walmart. Following we briefly describe five of these:

Agrosmart – Gathers farm and landscape-level climate and crop data, using farmer own record-keeping via its field notebook app, as well as by collating sensor data, using satellite images and public databases. The company says it has the largest climate intelligence platform in Latin America, and is present in countries including Brazil, the United States, Argentina and Paraguay.

AgTrace – A traceability solution for tracking all stages in the food chain, from farmers to retailers, where users can input data across the product journey in various ways, from manually entering this on a web platform, to use of barcodes, data imports or via API. It says it uses blockchain technology to encrypt information.

Btracer – A blockchain-backed platform which allows consumers to check every supply chain step via QR Codes, certifying the origin, manufacturer data, validity, and characteristics of a given product, and allows farmers and producers to gather records, invoices, and certifications into one tracking application.

Safe Trace – Markets its own “Safe Trace seal”, for consumers interested to know where their food comes from, based on blockchain technology systems.

PariPassu – PariPassu is a Brazilian agribusiness technology company, offering solutions for traceability, quality inspection and operations management in the food production chain, with services including a traceability code for food products, documentation records, and transparency services for farmers to input information on food origin.

New Food Finance: Sign up for a 3-day free trial

“Green Transition” Deals of the Week

In our “Green Transition” space last week, we saw fundraising worth $89 million.

Sweden, November 29 – Ecobloom Technologies employs multispectral cameras and sensors to gather cloud-based data for AI-driven insights on crop growth, disease identification, and environmental monitoring. The company received undisclosed funding from Bling Capital.

Switzerland, November 28 – Cradle, a B2B biotech and AI startup, has developed a generative protein design platform that helps clients engineer improved variants of targeted protein sequences using machine learning. The company secured $73 million in Venture Capital funding, with participation from Index Ventures, Kindred Capital, and IVP.

United Kingdom, November 28 – Biotangents Ltd is developing next-generation molecular diagnostic assays and point-of-care devices to detect infectious diseases in livestock, focusing primarily on cattle. Biotangents raised $2.92 million in undisclosed funding, supporting its mission to transform livestock healthcare.

France, November 27 – Kapsera has developed an encapsulation technology utilizing alginate shells derived from brown algae to stabilize biological inputs and enhance their performance. Kapsera raised $4.44 million in Venture Capital funding from Banque des Territoires, Yield Lab, and Demeter.

United States, November 27 – Ascribe Bioscience produces natural crop protection products derived from non-microbe, naturally occurring molecules found in the soil microbiome. The company secured undisclosed funding from Source Agriculture.

Norway, November 25 – Kilter has introduced its AX-1 sprayer, which photographs crops, analyzes the images, and applies targeted micro-drops of pelargonic acid onto weeds. Kilter raised $8.55 million in funding from investors, including Pymwymic, Nufarm, ProAg Invest, SBG Invest AS, and Natural Ventures.

New Food Finance Resources

Our Monthly Market Report aims to increase transparency around market news and prices in our “green transition” space:

December 4: Monthly Market Report – November

November 6: Monthly Market Report – October

Our Deep-Dive Briefings each give the low-down on an emerging technology up-ending food production:

November 27: Cultivated Meat Optimisation and Innovation

November 13: Bacteriophages in green agriculture

October 30: Sustainable Animal Feed Additives

October 15: Proteins as Biological pesticides