Farm Digitalisation Goes Mainstream

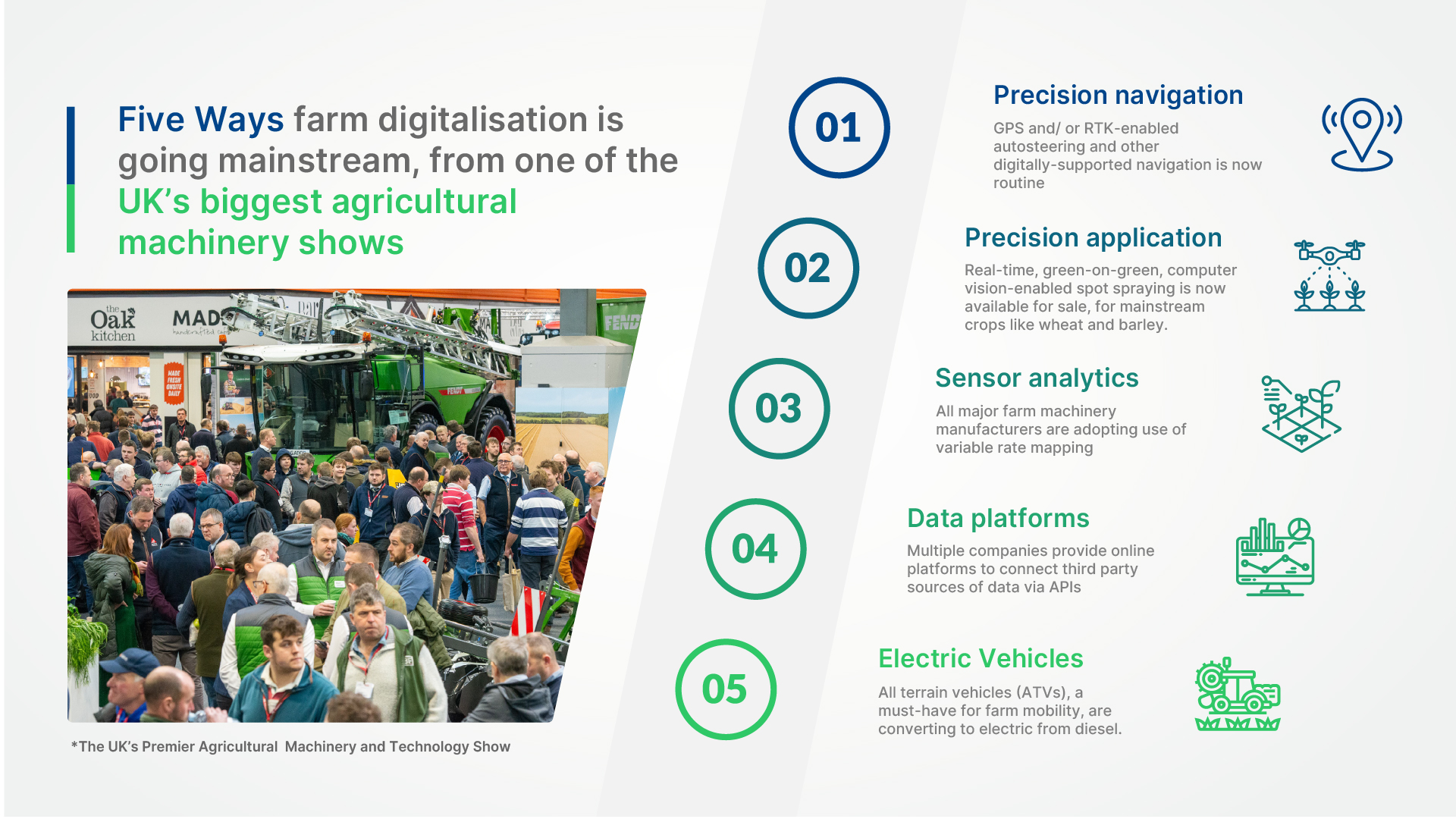

Graphic of the Week: Farm Digitalisation Goes Mainstream

Welcome to the New Food Finance weekly newsletter, where we report on a green transition in food and ag, highlighting the growth opportunity from tougher environmental regulation and shifting consumer choices.

This week, our newsletter is a day later than usual, after we attended LAMMA 2025, one of Europe’s biggest ag machinery and tech shows.

Adhering to our “green transition” theme, as ever, we found that:

Digital greentech is now deeply embedded in agriculture, deployed and ready for sale

The large equipment manufacturers are routinely applying precision tech such as variable rate drilling and spraying

However, in some cases, there is still a price premium, which is more visible than potential lifetime cost savings

Some greentech suppliers are keen to flaunt environmental subsidies, which in reality may be fickle and not to be depended on!

As we paced the giant halls at Birmingham’s cavernous NEC exhibition centre, in the UK, we found five ways in which farm machinery is going digital:

Precision navigation: it is now routine for modern tractors to have GPS and/ or RTK-enabled autosteering and other digitally-supported navigation, to waste less seed, product and fuel. Multiple companies provide these services as add-ons, to retrofit older or simpler machinery, such as PTx Trimble, and on a smaller scale, Field Bee and Agricision.

Precision application: at New Food Finance, we recently dug deep into the payback periods for real-time, green-on-green, computer vision-enabled spot sprayers. Carbon Bee is one of these companies, and on display at LAMMA 2025, with UK-based supplier RVT quoting a £60k ($73k) retrofit cost, with the potential for UK per hectare and upfront capital cost subsidies, and crop applications including wheat and barley.

Sensor analytics: one of the biggest agtech trends over the past decade has been the use of remote, drone and in-field sensor data, to drive insights for variable rate applications of chemicals and fertilisers. One company that maps such data, on display at LAMMA 2025, is SOYL, a part of UK commodities giant Frontier. In a New Food Finance survey of six driller manufacturers, at the trade fair, all said they enabled use of variable rate maps, via ISOBUS, a standard protocol that allows tractors and other agricultural machinery to communicate with each other.

Data platforms: multiple companies provide farmers and agronomists with online platforms and dashboards to aggregate third party data via API, from digital mapping to farm management data, with Ag Leader and Hutchinsons examples of these.

Electric Vehicles: electric tractors are coming, with battery capacity remaining an issue given the power requirement of farm machinery. In the meantime, smaller, all terrain vehicles (ATVs), a must-have for farm mobility, are converting to electric from diesel. Polaris quoted a £6k ($7.3k) premium for an electric ATV comparable to an £18k diesel model.

New Food Finance: Sign up for a 3-day free trial

“Green Transition” Deals of the Week

In our “Green Transition” space last week, we saw five fundraisings, worth $159 million, and one M&A deal.

Singapore, January 9 – enfarm Agritech has developed in-field nitrogen and moisture sensors with a transponder and app to advise farmers on soil nutrient levels and plant health. The company says its technology can halve fertilizer inputs by optimizing timing, type, and quantity. enfarm received undisclosed pre-venture capital funding from Touchstone Partners, Conservation Vietnam, and AiViet Venture.

India, January 9 – HiFeed says it produces affordable, nutritious cattle feed that reduces enteric fermentation, helping food producers achieve a net-zero carbon footprint in cattle. The company secured $2.2 million in pre-venture capital funding from Wavemaker Impact.

United States, January 9 – Rebellyous Foods develops automated factory processes for producing plant-based chicken using wheat and soy protein. The company raised $2.4 million in venture capital from Clear Current Capital and Agronomics.

Israel, January 8 – Fermata uses AI-supported cameras to automate crop scouting, to identify diseases early, detect pests, and monitor plant growth in greenhouses. The company says its Croptimus product reduces crop losses and pesticide use, supporting leafy greens, tomatoes and strawberries. Fermata raised $10 million in venture capital from Raw Ventures.

United States, January 8 – Inari uses gene editing to increase yields, reduce nitrogen and water use, and improve crop performance. Its predictive design engine combines machine learning and human interpretation, while gene editing tools like CRISPR enable precise genome alterations. Inari raised $144 million in venture capital from Abu Dhabi Investment Office, Hanwha Impact, NGS Super, and Flagship Pioneering.

Belgium, January 7 – Septentrio manufactures GNSS receivers for precision agriculture and other industries. Its receivers provide high-precision RTK positioning and are resilient to GNSS jamming and spoofing. Septentrio was acquired by Hexagon in an undisclosed M&A deal.

Regulatory News Round-Up: December

We found one update, in regulatory news last week:

New Food Finance Resources

Our Deep-Dive Briefings each give the low-down on an emerging technology up-ending food production:

December 10: Cutting Methane Emissions – Are Feed Supplements the Answer

November 27: Cultivated Meat Optimisation and Innovation

November 13: Bacteriophages in green agriculture

October 30: Sustainable Animal Feed Additives

October 15: Proteins as Biological pesticides