U.S. Ag Robotics Poised to Gain from Tighter Immigration

Graphic of the Week: U.S. Ag Robotics Poised to Gain from Tighter Immigration

Welcome to the New Food Finance weekly newsletter!

It is early yet to determine impacts of the return of U.S. President Donald Trump.

Some initial signs were not favourable for agri-food tech, green transition companies, which largely benefit from environmental policies.

For example, while the President disavowed The Heritage Foundation’s “Project 25” document, some of its contributors have since been elevated to his administration, and its headline agri-food recommendation was, to: “Denounce efforts to place ancillary issues like climate change ahead of food productivity and affordability when it comes to agriculture.”

To date, however, Trump’s relevant Executive Orders centre on the potential impact of sweeping tariffs on U.S. ag exports, of immigration rules on labour availability, and energy rule changes on corn-based ethanol.

Tariffs entail inflation risks which make discerning wider impacts complex and beyond the scope of a newsletter. It is much easier to draw a straight line between tighter immigration policies which disrupt farm labour supply, supporting demand for automation, already gaining from advances in AI.

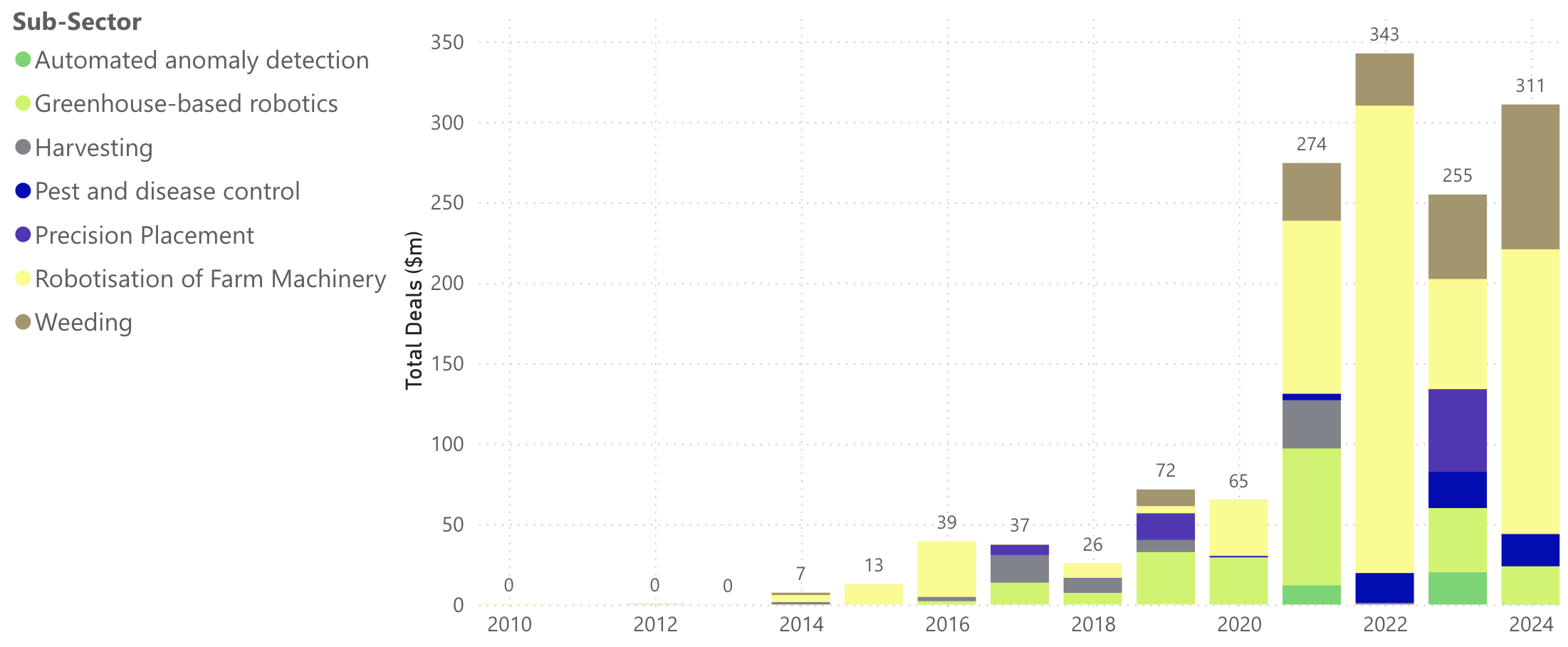

Our Graphic of the Week above shows how U.S. based ag robotics companies are already on a tear, fund-raising-wise, shaking off a wider VC fund-raising implosion last year, with particular investor interest in “robotisation” of machinery, such as tractor self-driving retrofits, and in weeding and greenhouse-based robots.

Leading U.S.-based ag automation companies, by fund-raising, include:

- Monarch Tractor (raised $282m) – Producer of an electric, self-driving tractor for repetitive tasks especially in perennial crops and orchards.

- Raven ($201m) – Producer of precision ag hardware and software, to simplify and automate farming. Its products include a line of guidance and assisted steering systems, from sub-meter GPS receivers and lightbar systems, to advanced automatic steering systems with sub-inch RTK corrections.

- Carbon Robotics ($137m) – Developer of driverless and tractor-towed weeders that identify, target, and eliminate weeds using thermal energy, in real-time, focusing on large-scale speciality crops.

- Iron Ox ($118m) – Operator of indoor hydroponic farms which it says rely on a mix of humans and robots to plant, manage and harvest crops. The robots scan for problem detection and adjust the amount of nutrients and water plants receive.

- Clearpath Robotics ($85m) – Developer of autonomous precision spraying and mowing robots with applications in agriculture. It was acquired by Rockwell Automation for $472m at the end of 2023

New Food Finance: Sign up for a 3-day free trial

“Green Transition” Deals of the Week

Here we summarise our green transition deals of the week, comprising seven fund-raisings worth $45 million, plus three M&A deals.

FRANCE, Jan 23 – AISPRID designs, manufactures and markets autonomous robots for fruit and vegetable producers. The company raised a series A financing round of €10 million, including €6.2 million in dilutive financing, led by Innovacom (Turenne Groupe).

ISRAEL, Jan 23 – Kokomodo is cultivated ingredients company, aiming to produce cacao using cellular agriculture technology. Israel’s Pluri Biotech has announced its intention to acquire approximately 71% of Kokomodo, valued at $4.5 million.

ISRAEL, Jan 23 – Pluri describes itself as a global leader in 3D cell-expansion technology, and is the parent of cultivated meat company, Ever After Foods. Pluri announced a private placement investment of $6.5 million, with investor Alejandro Weinstein.

FRANCE, Jan 22 – AuraLIP Low Impact Protein says it is developing controlled fermentation processes to produce high quality proteins, from hemp seeds. The company raised €500K to scale its fermentation technology, from investors including Business Angels Grandes Ecoles, Femmes BA and Yes Invest.

HUNGARY, Jan 22 – Eleszto Genetika describes itself as a leader in the genetic modification of yeast and other microbial platforms. The company was acquired by Pictor Biotech, created last fall by former Novozymes exec Peter Rosholm, who says he aims to create a vertically integrated synthetic biology and biomanufacturing powerhouse.

FRANCE, Jan 22 – GPC Bio says it provides turnkey control systems that offer a high level of automation and safety for bioprocessing equipment. Pictor Biotech has acquired the company, alongside Eleszto Genetika (see above).

GERMANY, Jan 22 – PROJECT EADEN is a Berlin-based food technology startup focused on developing realistic plant-based meat alternatives. The company raised a €15 million Series A round, led by Planet A and REWE Group.

INDIA, Jan 22- WayCool Foods connects farmers with retailers, and aims to promote sustainable agriculture practices. The company raised 38.2 crore rupees (around US$4.4 million), led by Trifecta Capital, with participation from Alteria Capital and Stride Ventures.

UNITED STATES, Jan 21 – Ginkgo Bioworks, Inc. is a B2B cell programming and biosecurity company. Ginkgo received $2.4 million from the Department of Energy, to develop precision fermentation technology for producing human lactoferrin.

UNITED STATES, Jan 21 – Tender Food says it produces whole-cut meat substitutes from natural plant protein fibres. The company was awarded $5.4million by the Department of Energy, to develop and scale a low-energy fiber-spinning system for producing plant-based whole-cut proteins.

Regulatory News Round-Up: December

Following is our regulatory news roundup from last week:

Jan 23 – Dutch Mosa Meat seeks EU approval to sell lab-grown beef fat.

Jan 23 – Animal-free dairy producer New Culture has submitted the product label and registration for its mozzarella to the California Department of Food and Agriculture (CDFA). It is believed to be the first time a label for a product made with animal-free casein has been submitted to the department for review.

Jan 23 – ‘A pivotal moment’ for regenerative agriculture, as Agreena secures Verra registration for soil carbon projects.

Jan 20 – Californian plant-based meat leader Impossible Foods has had a patent for its heme protein reinstated in the EU.

New Food Finance Resources

Our Deep-Dive Briefings each give the low-down on an emerging technology up-ending food production:

December 10: Cutting Methane Emissions – Are Feed Supplements the Answer

November 27: Cultivated Meat Optimisation and Innovation

November 13: Bacteriophages in green agriculture

October 30: Sustainable Animal Feed Additives

October 15: Proteins as Biological pesticides