The Opportunity in Soil Carbon and Nature Measurement

Tech companies that support on-farm production of environmental goods and services, such as carbon sequestration or crop pollination, are seeing sharply growing investment, where measurement of these public goods may be the biggest opportunity, as key to unlocking carbon and nature markets.

At New Food Finance, we have identified 23 broad-based sectors, spear-heading an environmental transition in food production, from the production of alternative proteins such as plant-based, fermented or cultivated meat substitutes, to low-impact, non-chemical, crop inputs, such as biological pesticides or “green ammonia”.

Among these 23 sectors, our “Carbon, Climate, Soil and Biodiversity” sector focuses on companies that aim directly to produce environmental goods and services, as opposed to doing so indirectly, via the supply of other, low-impact products.

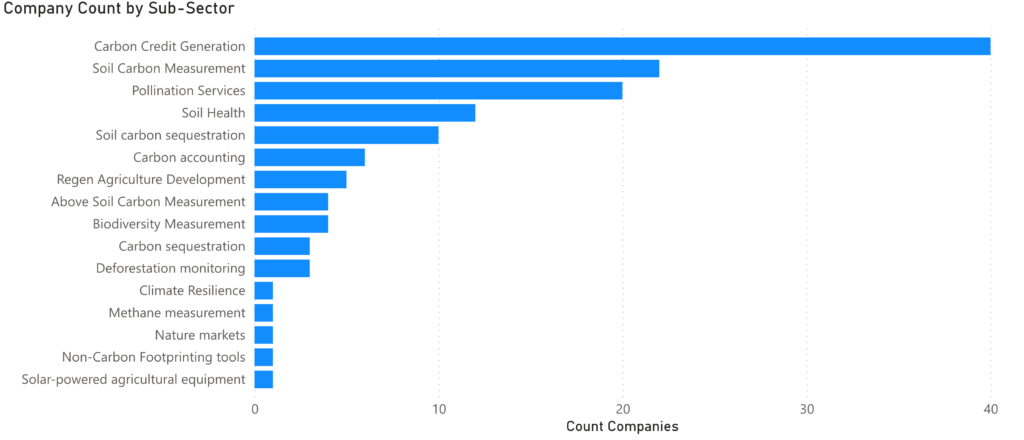

The chart above shows a count of these companies, broken down by “sub-sector”. Goods and services range from carbon project development, where companies generate carbon credits in return for low-carbon farm practices, to soil carbon sequestration, including production of biochar, as well as pollination services, by provision of native bees or hive monitoring services, and soil biology assessment, for example through metagenomic sequencing of soil samples.

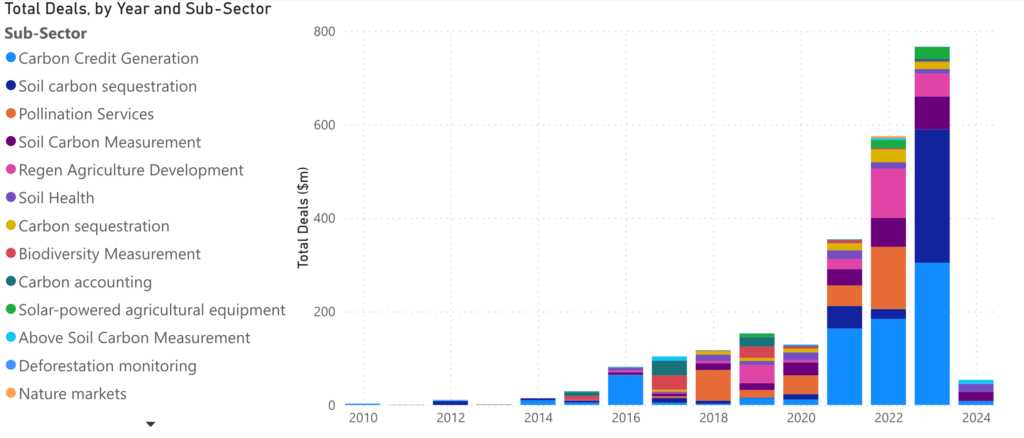

Investment is lumpy, reflecting dominance of the sector by a handful of big carbon project developers, where Indigo Ag alone has attracted 42% of the sector’s total cumulative $4.5 billion.

Indigo Ag has three core businesses: carbon credit generation; sustainable crop inputs; and a digital marketplace. Its carbon project business helps farms generate carbon credits, when they meet the requirements of the company’s own carbon standard.

Below is a corresponding chart to the company count, this time showing investment, excluding Indigo Ag, as an outlier.

Carbon project development and soil carbon sequestration still dominate, but the next big opportunity may lie with companies enabling carbon and nature markets, where soil carbon and biodiversity measurement are key, since without reliable, cost-effective monitoring, there can be no credible markets or pricing.

Note steady growth in soil carbon measurement, where key companies include Yard Stick, EarthOptics, Perennial, Agricarbon, Chrysalabs – and many more.

Annual investment across these 24 companies at present is in the tens of millions – reaching a new high of $70 million in 2023, and already at $20 million in 2024.

At the moment, on-farm biodiversity measurement – whether soil biology or other fauna – is niche. Could this be the next big thing? Early movers include FaunaPhotonics, AgriSound, BeeOdiversity, Digit Soil, Genesis and PES Technologies.

Across our database, investment in on-farm biodiversity measurement so far in 2024, at $17 million, already exceeds all of 2023 ($12 million).