Soaring prices draw investment in greener coffee and chocolate

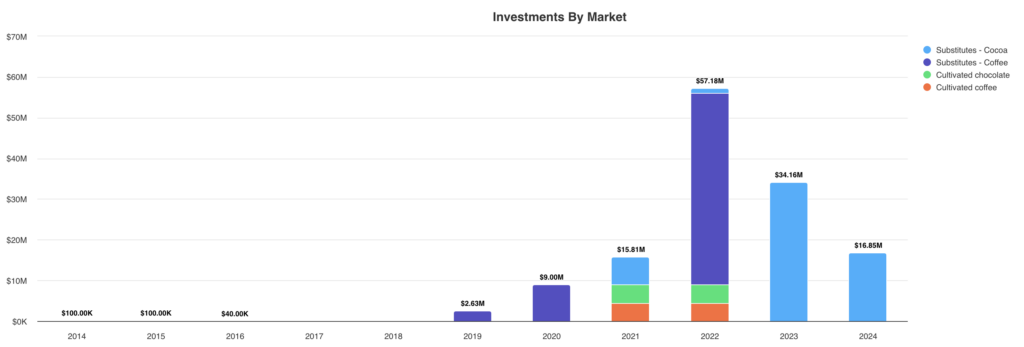

Strong growth in the substitute cocoa market (light blue bars)

Soaring coffee and cocoa prices, in part due to climate-related supply woes, have thrown a spotlight on investment in the sustainability, climate resilience and traceability of these two core, tropical country commodities, and in substitute products.

Extreme temperatures in South-East Asia and West Africa have hit the production of the modern day necessities coffee and cocoa, respectively, alongside other supply-side problems including failing investments in ageing plantations.

At New Food Finance, we analyse how tech and other companies are driving an environmental transition in food production, for example to cut greenhouse emissions and water and air pollution, as well as to restore biodiversity and boost climate resilience.

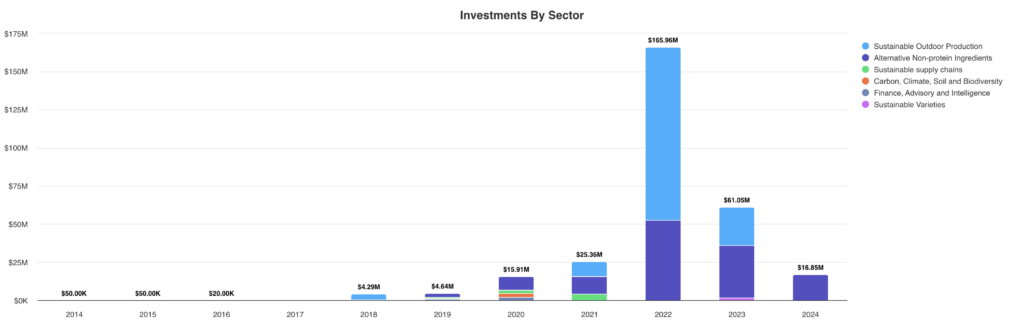

Investment in more sustainable coffee and chocolate appears well-diversified across multiple sector and technology categories, New Food Finance data show, indicating interest in the theme.

We identify 20 companies operating across six of our cleantech sectors, attracting a total of $288 million to date, with the development of cocoa substitutes showing the strongest 2023 and fastest start to 2024 (see chart above), against the backdrop of a global supply tightening.

On the foodtech side, start-ups are aiming to optimise fermentation solutions, across a wide variety of ingredients, to develop coffee and cocoa substitutes, while one company also aims to apply cell cultivation technology.

On the agtech side, companies are developing solutions including the breeding of more climate resilient varieties, as well as sustainable farm advisory, supply chain traceability tools, and enhanced crop pollination.

The chart below summarises these investments, and we dig deeper with an example company from each sector.

Sustainable production: The Green Coffee Company (cumulative investment $152 mln) is a vertically integrated coffee producer in Colombia, which says it promotes regenerative, Rainforest Alliance-certified, farming practices.

Alternative ingredients: UK-based Nukoko ($8.2 million) describes itself as a climatetech company that makes cocoa-free chocolate, replacing cocoa beans with local fava beans available far more widely, including in Britain.

Sustainable supply chains: Demetria ($4.5 mln) says it uses near infra-red sensors and other tools, such as smart phone cameras, to identify every harvested coffee bean, enabling a record of its quality as well as traceability across the supply chain.

Carbon, climate and biodiversity: AgroBee ($0.6 mln) says it has developed an app to connect beekeepers with producers, to increase pollination of staple crops including coffee, soy and sunflowers.

Advisory services: Courageous Land is an agroforestry consultancy company focused on transforming degraded lands into agroforestry, by designing, implementing, and managing regenerative and successional agroforestry practices, to boost output of forest products including cocoa and coffee.

Sustainable varieties: Amatera ($1.7 mln) says it uses in vitro culture to accelerate the development of new varieties of plants, focusing on perennial crops, and specifically coffee, initially, with a particular focus on more climate resilient varieties.