Green funding drops, growth sectors stand out

Chart of the Week – Green funding drops, growth sectors stand out

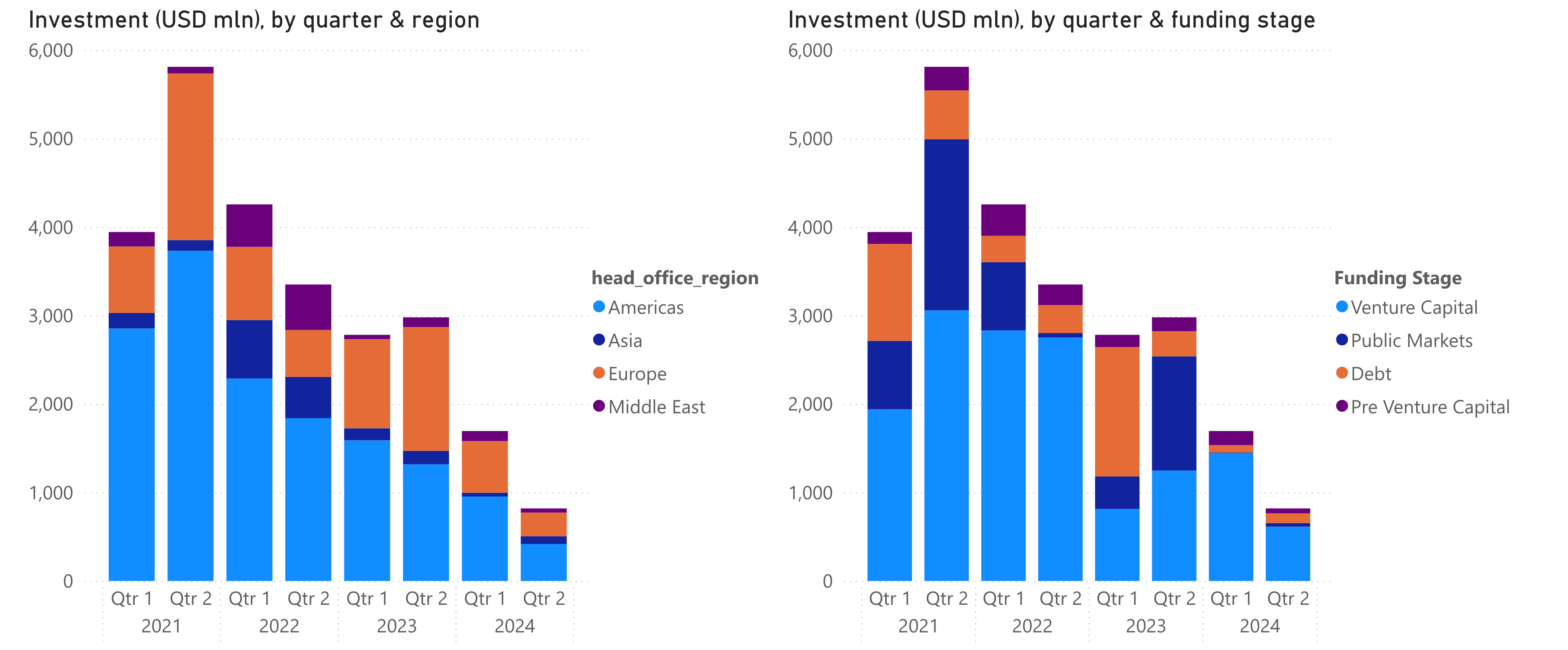

Company-level funding of a green transition in food production continued to fall globally, in the first half of 2024, with Europe now following the United States downwards after propping up investment last year, but high-growth sectors remain.

At New Food Finance, our focus is highlighting a green transition in food production. Our focus to date is tracking company-level investment, including via government grants, as well as seed, venture capital, private equity and public and debt fund-raisings.

Our chart of the week shows that investment continues to fall globally, comparing 2024 H1 vs 2023 H1, continuing a downward trend since an investment peak in 2021.

A drop in company-level investment has been a feature across the global economy, attributed to higher interest rates, in particular, squeezing company growth and refinancings, as well as investor returns and exit opportunities.

At New Food Finance, we have created a taxonomy to define an agri-food green transition, including more than 100 sectors and sub-sectors, and more than 1,500 markets and technologies. This taxonomy enables detailed, granular data aggregation. Using this taxonomy, we highlight continued growth trends.

For example, bucking the general trend, following are examples of three of the top sectors that grew from H1 2023 to H1 2024:

Integrated Pest Management – this sector saw its highest H1 investment since 2020. An example was WeedOUT’s $8 million funding in February.

Robotics and Automation – H1 growth was led by investment in the Middle East and Europe. One example was Belgium-based Robovision’s $42 million funding in March.

Carbon and biodiversity – This sector comprises direct provision of public goods, for example via carbon and nature markets or MRV, and saw continued H1 on H1 growth. The standout fund-raising was Indigo Ag’s $270 million raising in January.

New Food Finance: Sign up for a 7-day free trial

“Green Transition” Deals of the Week

United Kingdom, July 18 (£150k) – Integrated pest management company, Permia Sensing, secured £150K from the British Design Fund. The Imperial College spinout has developed a portable sensor solution to detect Red palm Weevil larvae in coconut palm trees.

United Kingdom, July 16 (Undisclosed) – The plant-based pet food producer, HOWND, was acquired by Pets Choice.

What We’re Reading

FT (July 22) – UK becomes first European country to approve lab-grown meat

TheAgriBiz (July21) – Software is taking over everything. Now it’s animal health’s turn

Canal Rural (July 21) – Startup launches carbon footprint calculator for livestock farming

AgroLink (July 19) – Orion Group launches new LYNX brand and revolutionizes the market for biological products in the planting furrow

FAO (July 17) – FAO Director-General visits Mongolia and DPRK reaffirming FAO’s commitments to supporting sustainable agrifood systems transformation in developing countries:

Beef Magazine (July16) – Cargill invests $1m in research on methane reduction in cattle

Yara (July 16) – PepsiCoEurope and Yara partner to decarbonize crop production

Asia Food Journal (July 16) – LeprinoFoods and Fooditive Group sign exclusive agreement to commercialize non-animal casein worldwide

Green Queen (July 15) – Nestlé has unveiled a new high-yielding arabica coffee variety in Brazil, which is resistant to the impacts of climate change.

Ontario (July 15) – Ontario Investing in Innovative Agri-Food Research:

FT (July 3) – Climate change is pushing up food prices — and worrying central banks