Startups set to benefit from regen ag asset management

Chart of the Week – Startups set to benefit from regen ag asset management

Three deals in the past month show how regen ag is emerging as a “real asset” class, within farmland, drawing asset managers expecting both food and environmental market income streams, as well as a sustainable investing benefit.

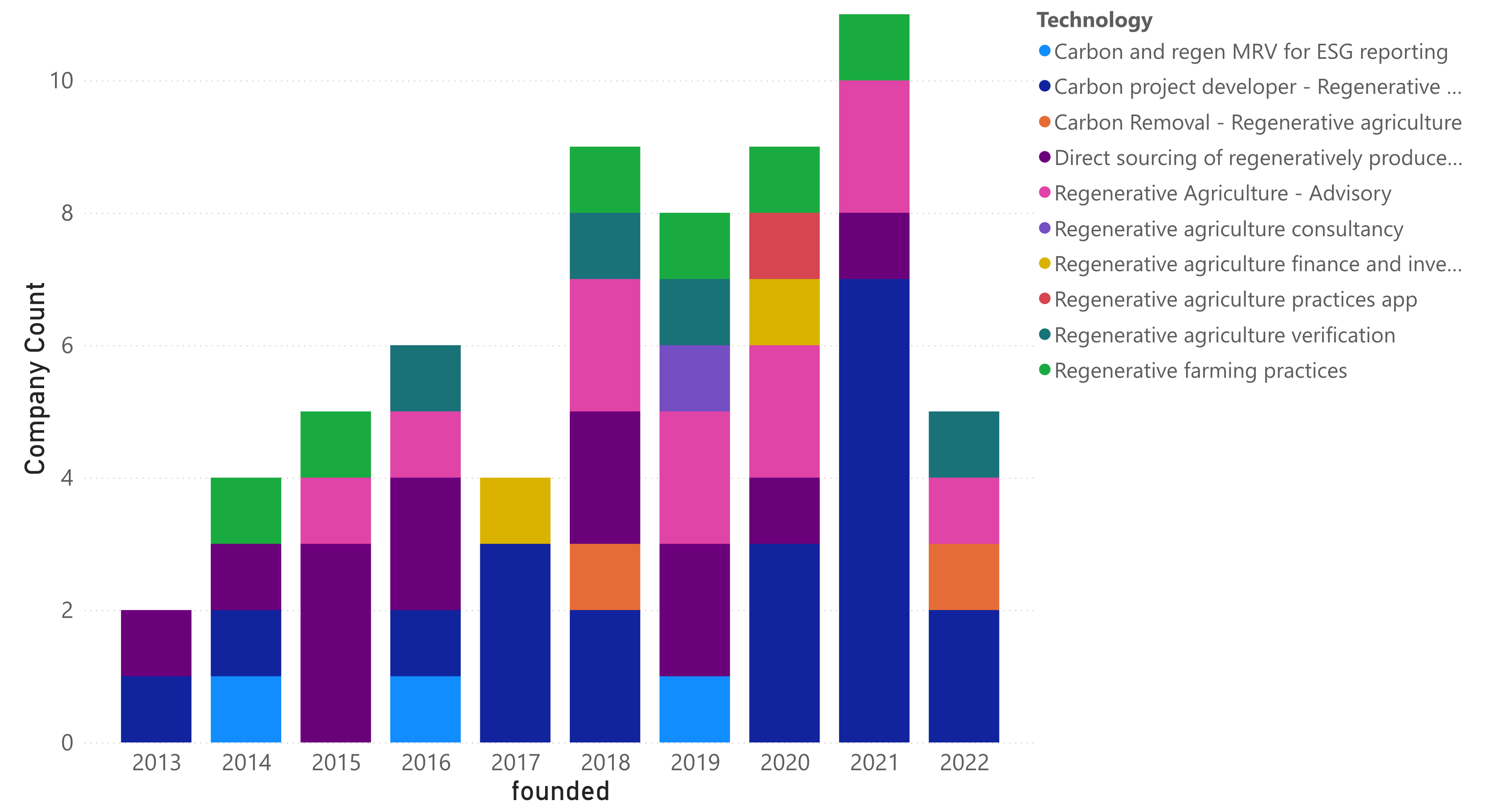

Our Chart of the Week illustrates some of the startup and agtech themes poised to benefit, across business models ranging from regen ag MRV and advisory to carbon credit development, and how the number of new companies is rising.

Regenerative agriculture, or regen ag, is a set of farming practices which together seek to minimise chemical inputs while adopting certain tillage practices, with a particular focus on supporting soil health and boosting soil carbon.

Its prescriptions are far less specific than organic agriculture, which can be seen both as a plus and minus, the latter especially with respect to difficulties of reporting and verification, which might undermine its financial marketability and environmental credibility.

Nevertheless, three deals show how regen ag is now seen as ripe for attractive, impact investing returns.

First, on August 28, a blank cheque company sponsored by private equity firm Riverstone and Impact Ag Partners acquired Australian Food & Agriculture Company Limited for $510 million. ANSC (Agriculture & Natural Solutions Acquisition Corporation) said it intended to create an “agricultural decarbonization and premium product company”, and regen ag leader, starting with this acquisition of AFA, a company with land holdings exceeding 225k hectares.

Second, on September 4, timberland and farmland real asset manager, Conservation Resources, announced a $47 million final close on its inaugural North American farmland private equity fund, seeking to “develop and monetize the agricultural and environmental values of the properties in which it invests”. The firm said that the capital was already deployed, in owned or leased organic or regeneratively farmed land, achieving income streams including from carbon sequestration and methane reduction, as a result of regenerative farming practices.

Third, on September 11, Microsoft’s Climate Innovation Fund announced it would invest in Vital Farmland III LLC, Farmland LP’s latest, $250 million real-asset fund dedicated to converting conventional farmed land into organic or regen ag. Microsoft’s contribution would focus on helping develop soil carbon credits across Farmland LP’s existing 18,500-acre portfolio, and expanding the market for regenerative soil carbon credits.

New Food Finance: Sign up for a 3-day free trial

“Green Transition” Deals of the Week

In our “Green Transition” space last week, we saw fund-raising worth over $115 million and two M&A deals:

United States, September 19 – Applied Carbon, formerly Climate Robotics, has developed a mobile solution to convert crop residue into biochar. The biochar is enriched with nutrients and microorganisms before being deposited in the soil. The company raised $0.50 million in a grant from The Wilkes Center for Climate Science & Policy.

United States, September 19 – Arzeda, based in Seattle, designs proteins and enzymes for food production, nutrition, and sustainable materials. Using physics-based protein design and AI, for example, it accelerates plant-based oil innovation. The company raised $38 million from Sofinnova Partners, Fall Line Capital, and others.

United States, September 19 – Bloomfield Hills Robotics, based in Pittsburgh, uses AI-driven monitors to assess vineyards’ plant health. Kubota acquired the company in an undisclosed M&A deal.

New Zealand, September 19 – Lucidome Bio is developing a vaccine to reduce methane emissions in ruminants. The company raised $8.42 million from the New Zealand Agricultural Greenhouse Gas Research Centre and AgriZeroNZ.

United Kingdom, September 19 – Zevero, a London-based decarbonization platform for FMCG companies, helps manage and reduce carbon footprints. Zevero raised $7.04 million from East Ventures and Spiral Capital.

United States, September 19 – Pairwise, a CRISPR specialist, is advancing plant-based foods and gene-edited crops through its Fulcrum platform. The company raised $40 million from Corteva, Deerfield Management, Aliment Capital, and Leaps by Bayer.

United States, September 18 – EnGeniousAg, based in Ames, Iowa, designs nutrient sensors for crops, soils, and water. The company was acquired by CropX for an undisclosed sum.

United States, September 17 – Switch Bioworks engineers microbes for biostimulants that help plants fix nitrogen. The company raised $17 million from The Grantham Foundation, Astanor Ventures, and others.

France, September 16 – Standing Ovation, based in Paris, replicates caseins to produce animal-free dairy and lactose-free cheese substitutes. The company raised $4.17 million from Astanor Ventures, PeakBridge, and others.