Bacterial Pesticides: Beating the Incumbents

Graphic of the Week – Bacterial Pesticides: Beating the Incumbents

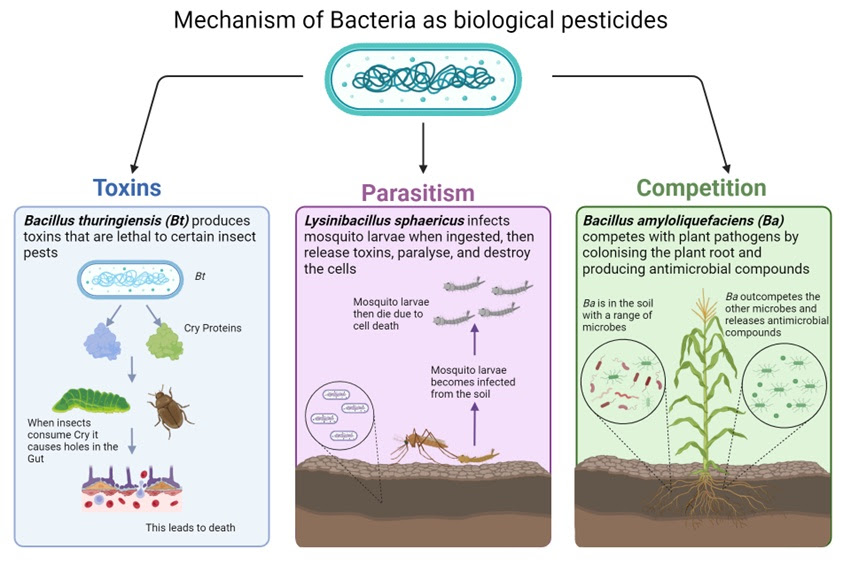

Microbe-based pesticides have sustainability advantages over chemicals: they may be less toxic, target pests more specifically, break down quickly and harmlessly, and they may be less likely to trigger pest resistance.

However, questions remain over their relative efficacy and price point, while they face the challenge of disruptors in a well-organised, chemical inputs industry.

Manufacturers of microbial pesticides are often keen to stress a less stringent regulatory environment, compared with chemical pesticides, which can cut product approval times and development costs. Their products may also be cheaper to develop because of their natural origin.

According to the International Biocontrol Manufacturers Association (IBMA), the development cost of a microbial pesticide is typically between $5 million and $10 million, compared to $250 million for a new chemical pesticide.

However, the easier wins may end there.

There are complications for disruptors, aiming to up-end an industry whose incumbents have well-honed marketing and distribution channels. In addition, the greater negative environmental impacts of chemical pesticides are typically un-costed, because of the public good characteristics of biodiversity protection, throwing the cost focus onto biologicals.

And there are concerns over the efficacy of biologicals, concerns which may be heightened by poor familiarity.

Practical challenges include:

Slower acting: large-scale commercial farmers may avoid microbial pesticides fearing slower results, compared to chemical options, which may act more quickly to prevent crop losses.

Market access: microbial pesticide manufacturers may face hurdles in scaling production and accessing well-established distribution channels dominated by chemical pesticide suppliers.

Low Awareness and Training: farmers may be less familiar with microbial pesticides, with limited training or access to knowledge about their use, which in turn discourages adoption

Biological pesticides are often made of living microorganisms which need specific conditions to thrive and function. Extreme heat, moisture levels and UV exposure can all reduce their efficacy. Proper storage and application of biopesticides is therefore important.

Below we highlight selected companies which are focused on smoothing the adoption and commercialisation of microbials.

PACKAGING AND DELIVERY – 3Bar Bio describes itself as a microbe delivery and manufacturing company that partners with microbe discovery and commercialization companies. The company provides packaging of living microbial products developed by partner companies, for delivery as sustainable inputs to farmers.

REGULATORY APPROVAL – Bioceres Crop Solutions specialises in partnering with start-ups and academic labs preparing new biological crop solutions, and then bringing them to market, including achieving registration approvals.

EDUCATION – Agrobiota is a consultancy services provider which specializes in promoting sustainable farming practices through the use of biotechnology, and especially by the application of microbial solutions.

ADVISORY – SynDev says it assists farmers and stakeholders in the agricultural sector to adopt more environmental friendly practices. The company optimizes biosolutions through a decision support app, called SynApps, for products made from natural raw materials, including biofertilizers, biopesticides and biostimulants.

COST REDUCTION – LiveGrow‘s focus is a patented microbial fermentation and formulation technology that it says is capable of manufacturing microbial products with costs on a par with chemicals, and a shelf life of two or more years at room temperature. It says that its R&D team can create a metabolically active, highly concentrated, shelf-stable commercial formulation from any microbe in under 3 months.

Product Launch: Deep Dive Briefings!

New Food Finance is excited to introduce a new feature for platform subscribers, a forthcoming series of fortnightly Deep Dive Briefings.

Each briefing will give the low-down on an emerging technology which is up-ending food production, providing top company exponents, and fund-raising trends. Subscribers to our platform will receive the briefings first, directly to their email.

Check out our first two briefings, on Genetic Manipulation and Protein-based Biological pesticides!

New Food Finance: Sign up for a 3-day free trial

“Green Transition” Deals of the Week

In our “Green Transition” space last week, we saw fundraising worth $106 million, and one asset sale.

United States, October 11 – California Cultured aims to use cell cultivation techniques to produce coffee and chocolate in bioreactors. The company raised an undisclosed amount from Sparkalis.

Germany, October 10 – forward earth is a Berlin-based startup which uses AI-powered software solutions to help companies achieve environmental compliance, including supply chain carbon emissions. The company raised $4.92 million from Mosaic, Speedinvest and Revent.

Italy, October 10 – xFarm offers satellite and IoT-based precision agriculture services through its app and dashboard, including workflow management, variable rate mapping and inputs advisory. The company raised $39 million from Partech, Mouro Capital, Swisscom Ventures, and United Ventures.

Canada, October 9 – Vision Greens operates a fully automated vertical farm in Ontario, producing local greens and herbs. The company raised $5.84 million in debt and $7.29 million in venture capital from Farm Credit Canada and others.

United States, October 9 – The Jackfruit Company specializes in vegan and vegetarian dishes based on jackfruit, sourced from more than 1,000 farms in India, and retailed in the United States. The company raised $5 million from InvestEco Capital, Creadev, and Grosvenor Food & AgTech.

Spain, October 8 – UOBO has developed a cholesterol-free, plant-based egg. The company raised $0.55 million from Enzo Ventures.

United States, October 8 – AgroSpheres has developed an RNAi-based approach to targeting specific pests, using biodegradable seed encapsulation to deliver its product. The company raised $12 million from Zebra Impact Ventures, Mirabaud Asset Management and others.

Netherlands, October 8 – Animal feed and health specialist dsm-firmenich completed the sale of its yeast extract business to Lesaffre.

France, October 7 – La Vie produces vegan pork substitute products, using soy protein, including vegan bacon and ham, marketing its products via distributors and partner restaurants. The company raised $27.44million from Zintinus and Sparkfood.

Switzerland, October 7 – Planetary SA describes itself as a full-stack mycoprotein and precision fermentation platform, to enable biomanufacturing at scale. The company raised $3.51 million from Cosun.