Carbon Farming Is Work in Progress

Graphic of the Week: Carbon Farming Is Work in Progress

Welcome to the New Food Finance weekly newsletter!

This week, we review “carbon farming”, and the prospect for farmers to earn carbon offsets to supplement their income, for example by adopting practices which sequester the greenhouse gas carbon dioxide in the soil.

The farm carbon project developer, Agreena, last month achieved compliance with Verra’s “Agricultural Land Management” carbon project methodology – esoterically named VM0042 – the first large-scale developer to do so.

Agreena has already achieved compliance with general international standards, as certified by the assurance body DNV. Getting the extra Verra stamp of approval may help scaling, given Verra is the world’s biggest carbon market registry, potentially helping farmers monetise their carbon offsets more easily.

Standard setter Verra aims to drive voluntary carbon market credibility by following a system of assurance and oversight, where independent bodies assess projects and any carbon offsets they generate, while also maintaining a registry which tracks projects and carbon credits.

There is little doubt that Agreena will benefit from achieving the milestone of Verra approval. However, the closure of rival carbon farming project developer, Nori, last year, reminded market participants of the “challenges of a stagnant Voluntary Carbon Market and tough funding environment.”

In addition, there remains a maze of carbon farming rules, which may be rigorous, but still make buyers and sellers wary of stepping into this market.

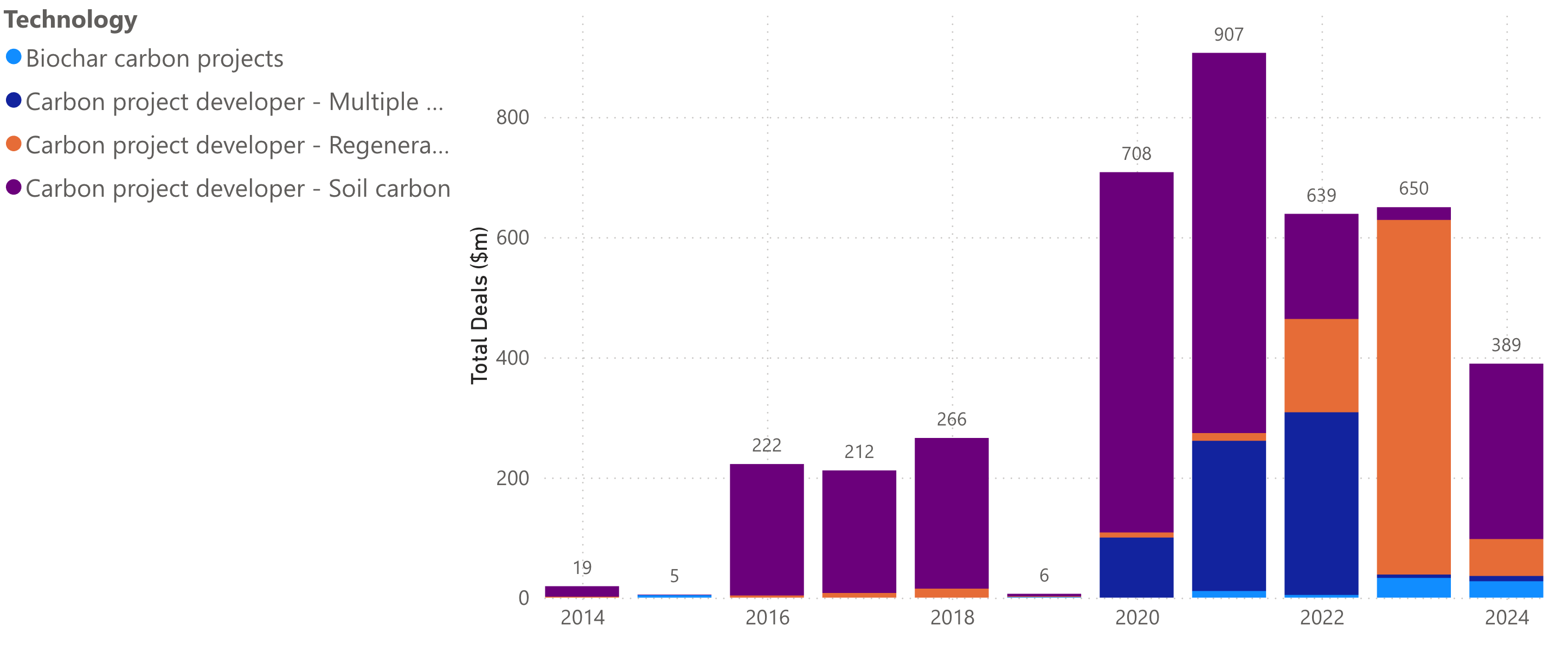

At New Food Finance, we track agtech and foodtech companies aiming to reduce the environmental impact of food production. We find carbon farming project developers have raised $4 billion in the last decade, rising over time (see Graphic of the Week).

In descending order of fund-raising, we find these companies using a range of standards and/ or assurance bodies:

Indigo Ag: has three core business themes: carbon credit generation; sustainable crop inputs; and market making. In carbon, Indigo has achieved approval for carbon credits issued by its projects, under the Climate Action Reserve’s Soil Enrichment Protocol in the United States.

GreenCollar: says it is the largest supplier of nature-based Australian Carbon Credit Units (ACCUs) to the Australian Government, and is actively working to generate new demand for high integrity ACCUs in the voluntary carbon market.

NetZero: is a biochar production company that uses pyrolysis to convert crop residues into biochar, which is subsequently incorporated into the soil, to sequster carbon and generate carbon credits. NetZero says its projects are certified by the ICROA-endorsed Puro Standard.

Klim: has produced an app which it says supports farmers to transition to regenerative agricultural methods. Klim monitors progress through farmer-centred photos of their practices, as well as satellite images. The company says its resulting carbon credits are TÜV-validated and certified, and “aligned with” Verra’s VM0042.

eAgronom: says it calculates the carbon credits generated on a farm, based on increased carbon levels in the soil. It says third party verifiers validate and verify these data, and that it “follows strict methodologies defined by the Verra Standard”.

New Food Finance: Sign up for a 3-day free trial

Who Are We?

At New Food Finance, we track opportunities from cutting the environmental impact of food production. Our database is updated DAILY, tracking the biggest and best data and news sources on agtech and foodtech online worldwide.

Our platform comprises:

>3,600 agtech and foodtech companies

>8,500 investors in and 500 acquirors of these companies

>$105 billion fund-raising transactions

$50 billion M&A deals

Proprietary Taxonomy – Using more than 1,700 markets and technologies

“Green Transition” Deals of the Week

In our “Green Transition” space last week, we saw 8 fundraisings worth $80 million.

United States, January 30 – Liberation Labs is building large-scale precision fermentation facilities to improve cost efficiency and production yield for novel bioproducts. The company raised $50.5 million in debt financing from NEOM, Meach Cove Capital, Agronomics, New Agrarian Company, Siddhi Capital, and Jim Mellon.

Switzerland, January 30 – Voltiris develops solar modules that filter light for agricultural productivity while generating electricity through photovoltaic cells. The company raised $5.28 million in pre-venture capital from EquityPitcher Ventures, 3M Ventures, and Satgana.

Norway, January 30 – Avisomo manufactures modular vertical growing racks with automation for lighting, irrigation, and fertigation, enabling scalable indoor farms. The company raised $5.2 million in venture capital from Innovation Norway and Element Logic.

Australia, January 30 – Levur engineers microorganisms, particularly yeast, to produce oils identical to palm oil using precision fermentation. The company secured $100,000 in grants from KPMG.

United States, January 29 – Bonsai Robotics integrates cameras and AI-driven navigation systems to enable autonomous tractors in complex environments like orchards and vineyards. The company raised $15 million in venture capital from Bison Ventures, Cibus Fund, Acre Venture Partners, Congruent Ventures, Fall Line Capital, E14 Fund, SNR, and Serra Ventures.

United States, January 29 – Ascribe Bioscience produces natural crop protection products from non-microbe, naturally occurring molecules that enhance plant defense mechanisms. The company raised an undisclosed amount in venture capital from ICIG Ventures.

Netherlands, January 28 – Agurotech develops a smart irrigation service for outdoor crops, using wireless sensors to measure soil moisture, air humidity, pressure, and temperature. The company raised $2.35 million in venture capital from Navus Ventures, ROM InWest, and Rabo Investment.

Germany, January 28 – ingarden produces compact indoor growing units for home-based microgreen cultivation. The company raised $1.25 million in pre-venture capital from Gemüsering Stuttgart GmbH.

Regulatory News Round-Up

Our Regulatory News Round-Up from last week:

Jan 30 – InnerPlant says it has taken a “meaningful step” in its regulatory journey for genetically engineered “sensor plants”

Jan 30 – Those Vegan Cowboys targets US launch for animal-free casein ahead of €15m fundraise