Food system fund-raisings lag climate challenge

Graphic of the Week: Food system fund-raisings lag climate challenge

Welcome to the New Food Finance newsletter!

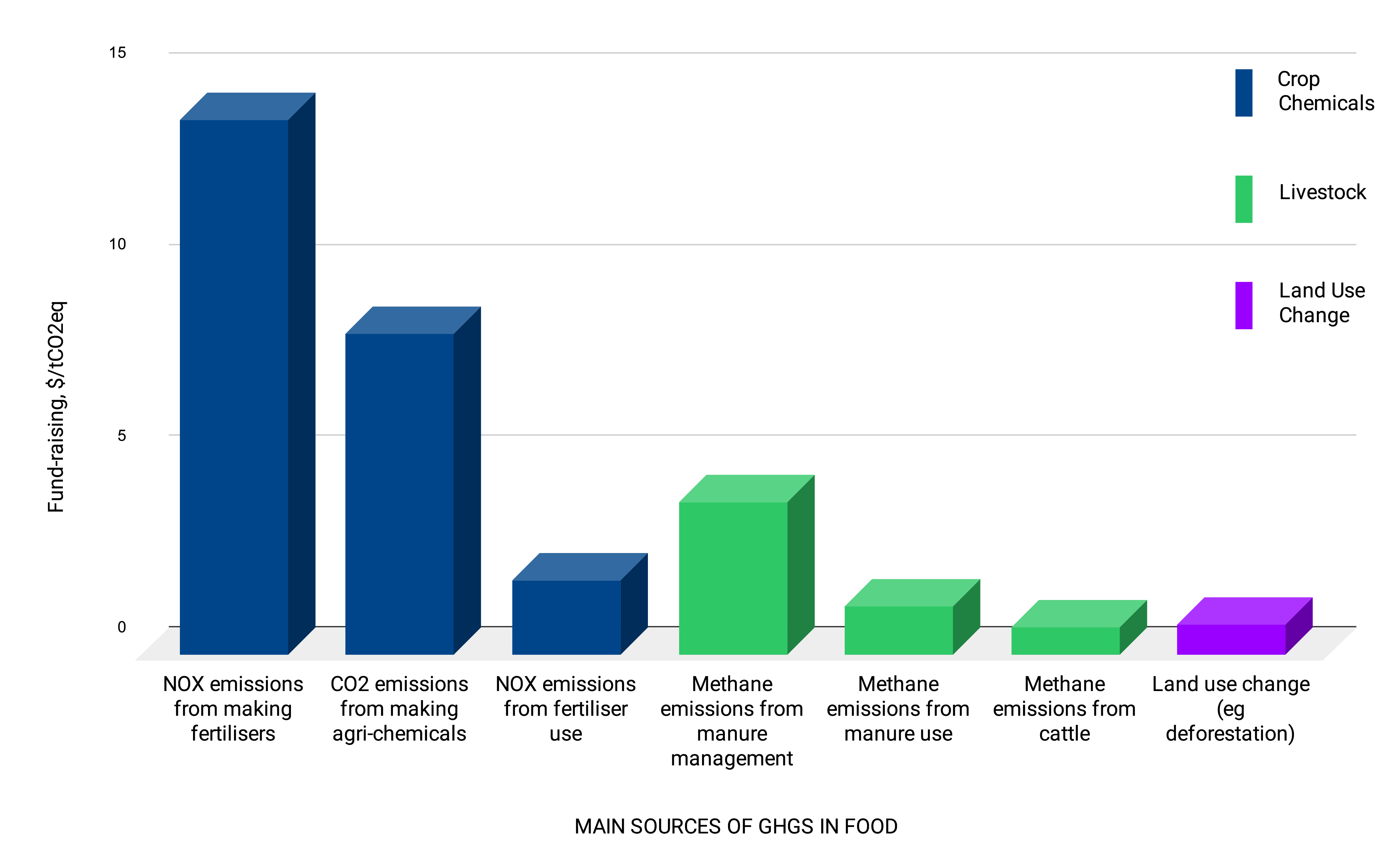

This week, we calculate company-level fund-raisings per tonne of greenhouse gas emissions from food and agriculture.

We find average company-level investment of just $1.44 per tonne of food system greenhouse gas emissions, per year, highlighting the mountain to climb, for these investments to match the scale of the problem ($17.4B annual fund-raising vs 12.1B tCO2eq annual emissions).

In this analysis, our goal was to identify gaps in climatetech investment, by emissions source.

We based our emissions data on a Nature journal article, published in 2021, which described food system greenhouse gases by source (in 2015), from deforestation (“land use change”); crop chemicals (manufacture and use); manure (storage and use); and methane emissions from cattle (“enteric fermentation”).

The article calculated total annual food system emissions of 18 billion tonnes of CO2 equivalent, a third of the global total – underscoring the scale of food system challenge. We focus on farm-level emissions, which account for the majority.

At New Food Finance, we have tracked some $106 billion investment in 3,600 agtech and foodtech companies cutting the environmental impact of food production, and tagged these according to nearly 2,000 markets and technologies.

We used these company-level data (from 2020 to 2024) to calculate annual fund-raising per tonne of annual emissions, according to the Nature article’s broad emissions sources (see our Graphic of the Week, above).

Our main findings were:

Crop chemicals: Technologies to cut the environmental impact of these chemicals have received the most fund-raising, per tonne of emissions, to date. Relevant technologies include robotics, crop breeding, precision ag, integrated pest management and biological controls. These may have received the most investment per tonne because they provide additional, on-farm productivity benefits, besides largely unpaid for emissions benefits.

Companies that have already raised funds in 2025 include enfarm, which has developed in-field nitrogen and moisture sensors, which it says can help farmers halve fertiliser inputs, as well as Agurotech and Waycool.

Second comes methane emissions from livestock, including from manure management, and from enteric fermentation. These emissions sources have received around one order of magnitude less investment, per tonne of GHGs, compared with crop chemicals. One explanation is the size of the problem: the food system is a massive source of methane emissions, at 6.3 billion tonnes annually. Relevant technologies and investments include in alternative proteins, precision livestock, and sustainable livestock inputs.

Companies specifically aiming to reduce emissions from cattle, which have already raised funds in 2025, include CH4 and HiFeed.

Finally, the source category which has received the least investment per tonne of emissions to date is land use change. This category includes carbon emission from deforestation and peat draining, to make way for crops and livestock. Relevant technologies include alternative proteins, designer fats, supply chain tracking technologies, indoor farming and crop breeding for higher yields. This land use change category is by far the biggest single source of carbon emissions from the food system today, at 5.8 billion tonnes CO2 annually.

One standout fund-raising year to date in the crop breeding category is Inari, which raised $144 million in January, and says it uses predictive design and gene editing, to increase production significantly, for a given area of land.

In a procedural note, at New Food Finance, going forwards, we have decided to switch to a monthly newsletter, from weekly. Our goal is to focus on achieving ever deeper insights, and scaling up our data gathering.

New Food Finance: Sign up for a 3-day free trial

Who Are We?

At New Food Finance, we track opportunities from cutting the environmental impact of food production. Our database is updated DAILY, tracking the biggest and best data and news sources on agtech and foodtech online worldwide.

Our platform comprises:

>3,600 agtech and foodtech companies

>8,500 investors in and 500 acquirors of these companies

>$105 billion fund-raising transactions

$50 billion M&A deals

Proprietary Taxonomy – Using more than 1,700 markets and technologies

“Green Transition” Deals of the Week

In our “Green Transition” space last week, we saw 8 fundraisings worth $80 million.

Belgium, February 6 – BiocSol specializes in developing microbial-based biopesticides, emerging as a spinout from UCLouvain’s research initiatives. The company raised $4.57 million in venture capital from Pymwymic and Win4Company.

Switzerland, February 6 – Koa Switzerland & Ghana upcycles cacao fruit into products such as Koa Pure juice, Koa Concentrate 72°, and cacao fruit powder. The company employs a mobile processing unit for on-site cocoa pulp extraction, enhancing sustainability. It raised $2.08 million in pre-venture capital from Faber, Fund F, and Swanlaab.

United States, February 6 – PlantBaby produces plant-based, soy-free, and dairy-free infant formula under its Kiki Milk brand. The company raised $4.00 million in venture capital from Big Idea Ventures, XFactor Ventures, B2 Partners, Everywhere Ventures, and Women’s Equity Lab.

Netherlands, February 5 – Mosa Meat, a cultivated burger manufacturer, raised $2.60 million in crowdfunding from undisclosed investors.

Denmark, February 4 – Enduro Genetics focuses on improving large-scale fermentations by integrating a “genetic plug-in” into microbial production hosts. This technology ensures only high-producing cells survive, eliminating non-productive ones. The company raised $12.45 million in venture capital from Supernova Invest, NOON Ventures, and Sandwater.

France, February 4 – Jay&Joy produces vegan cheese from almonds and cashew nuts. The company raised $2.07 million in private equity from Demeter, Beyond Impact, and Jean-Baptiste Rudelle.

France, February 4 – Les Nouveaux Affineurs applies traditional cheesemaking techniques to ferment and mature cashew- and soy-based cheese. The company was acquired by Jay & Joy for an undisclosed amount.

Regulatory News Round-Up

Our Regulatory News Round-Up from last week:

Feb 6 – Mosa Meat has filed to sell its cultivated beef fat for use in blended meat products in Switzerland, supported by Bell Food Group, the country’s largest meat processor, and an investor in Mosa Meat